Welspun Living Gets Price Target Cut From Jefferies – Here’s Why – Ndtvprofit.com

Published on: 2025-09-30

Intelligence Report: Welspun Living Gets Price Target Cut From Jefferies – Here’s Why – Ndtvprofit.com

1. BLUF (Bottom Line Up Front)

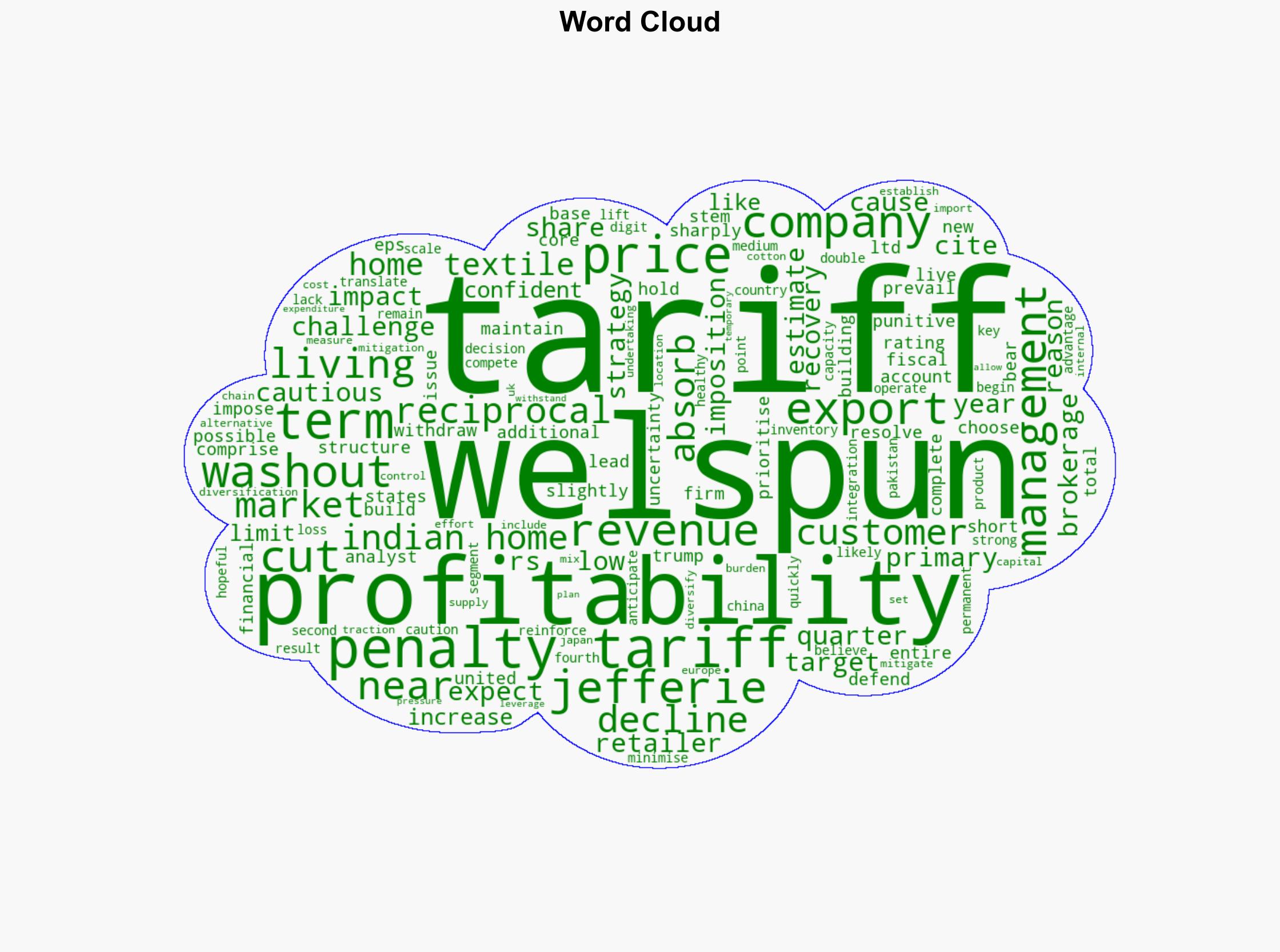

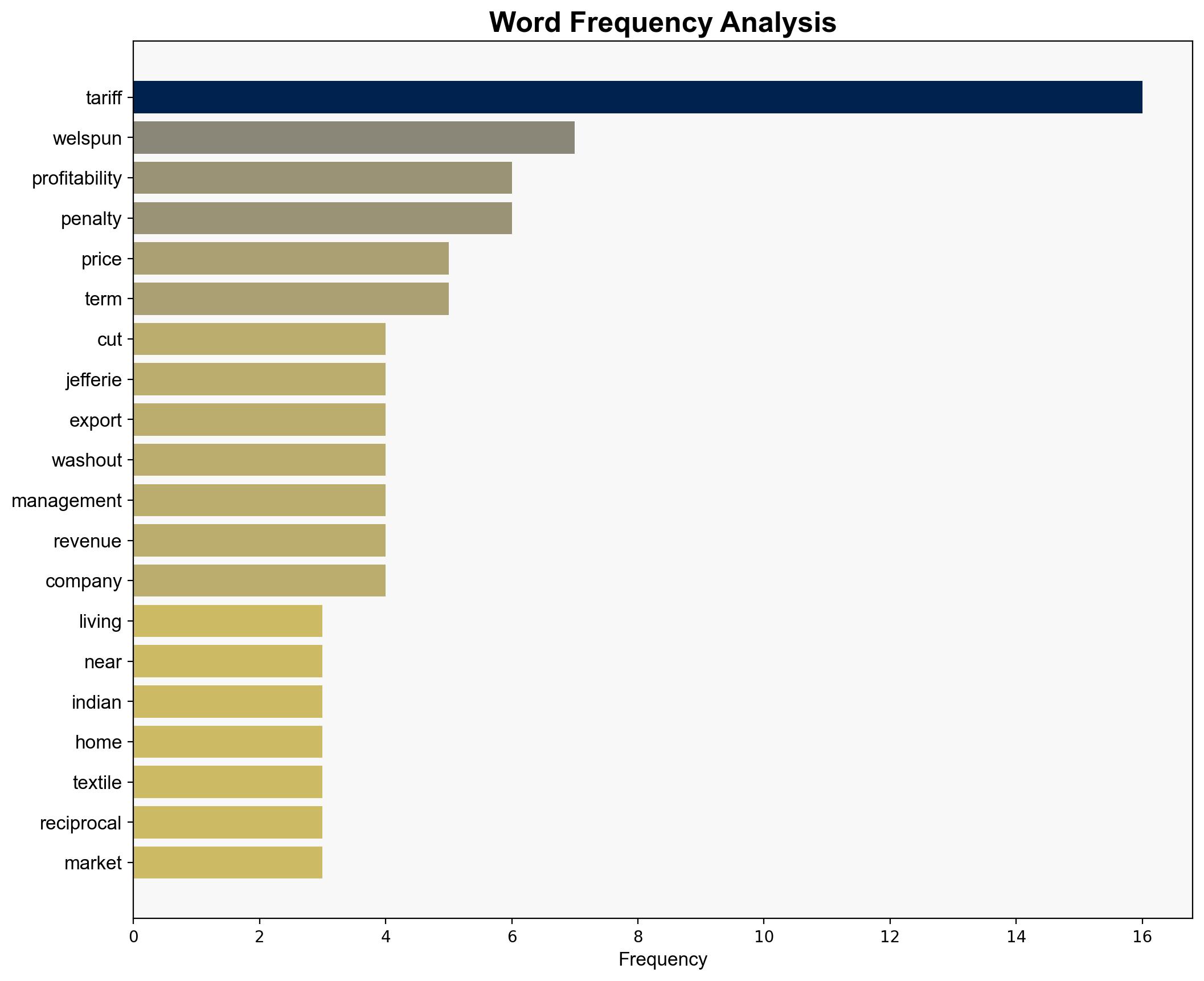

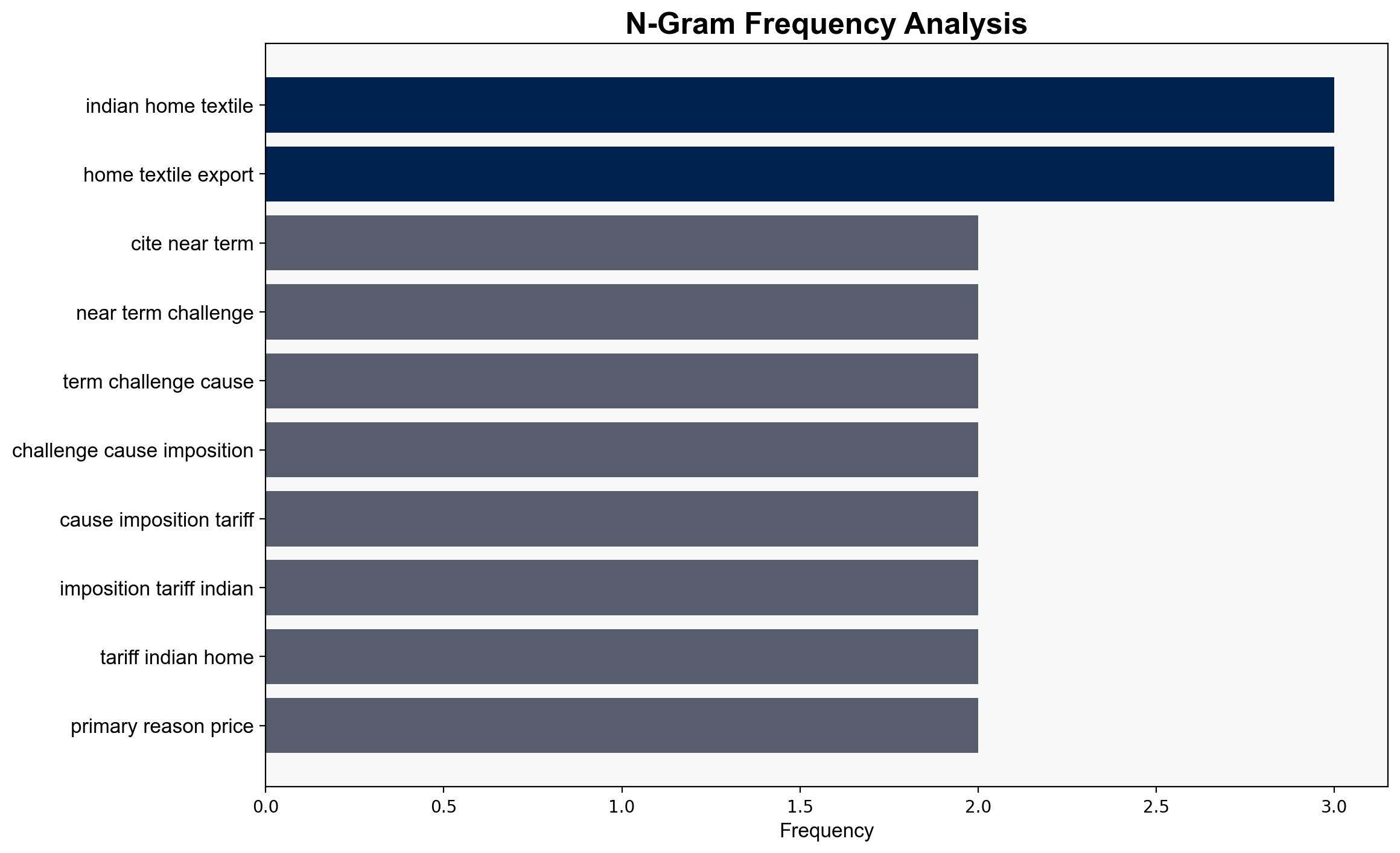

The price target cut for Welspun Living by Jefferies is primarily driven by the imposition of tariffs on Indian home textile exports to the United States. Two hypotheses emerge: (1) Welspun’s strategy to absorb tariffs will protect market share but result in short-term profitability loss, and (2) the strategy may lead to longer-term financial instability if tariffs persist. The first hypothesis is better supported by current data, given management’s confidence in market share retention and planned mitigation efforts. Confidence level: Moderate. Recommended action: Monitor tariff developments and assess the effectiveness of Welspun’s diversification and cost-control strategies.

2. Competing Hypotheses

1. **Hypothesis 1**: Welspun’s decision to absorb tariffs will safeguard its market share, leading to a temporary profitability washout but eventual recovery as tariffs are lifted.

2. **Hypothesis 2**: The absorption strategy will strain Welspun’s financial health, risking longer-term instability if tariffs remain or escalate.

Using ACH 2.0, Hypothesis 1 is more likely as it aligns with management’s confidence in market share retention and planned diversification efforts. Hypothesis 2 lacks immediate evidence but remains a potential risk if external conditions do not improve.

3. Key Assumptions and Red Flags

– **Assumptions**: The assumption that tariffs will be temporary and that market share retention justifies short-term losses underpins Hypothesis 1. Hypothesis 2 assumes prolonged tariff imposition and insufficient mitigation by Welspun.

– **Red Flags**: The absence of detailed financial projections post-tariff and reliance on management’s optimistic outlook without external validation.

– **Blind Spots**: Potential geopolitical shifts affecting tariff policies and competitor responses are not fully explored.

4. Implications and Strategic Risks

The primary risk is economic, with potential cascading effects on Welspun’s financial stability if tariffs persist. Geopolitically, changes in US-India trade relations could alter the tariff landscape. Psychologically, retailer caution may exacerbate revenue declines. A prolonged tariff scenario could lead to strategic shifts in supply chain dynamics.

5. Recommendations and Outlook

- Monitor US-India trade negotiations for signs of tariff resolution.

- Evaluate the effectiveness of Welspun’s diversification and cost-control measures quarterly.

- Scenario Projections:

- Best Case: Tariffs are lifted within the fiscal year, leading to a swift recovery in profitability.

- Worst Case: Tariffs persist, causing sustained financial strain and potential market share loss.

- Most Likely: Gradual recovery as mitigation strategies take effect, contingent on external trade developments.

6. Key Individuals and Entities

– Welspun Living

– Jefferies

7. Thematic Tags

economic impact, trade policy, market strategy, financial stability