What is WhatsApp Screen Mirroring Fraud that can drain your bank account and lead to identity theft Learn how you can avoid it – The Times of India

Published on: 2025-08-16

Intelligence Report: What is WhatsApp Screen Mirroring Fraud that can drain your bank account and lead to identity theft Learn how you can avoid it – The Times of India

1. BLUF (Bottom Line Up Front)

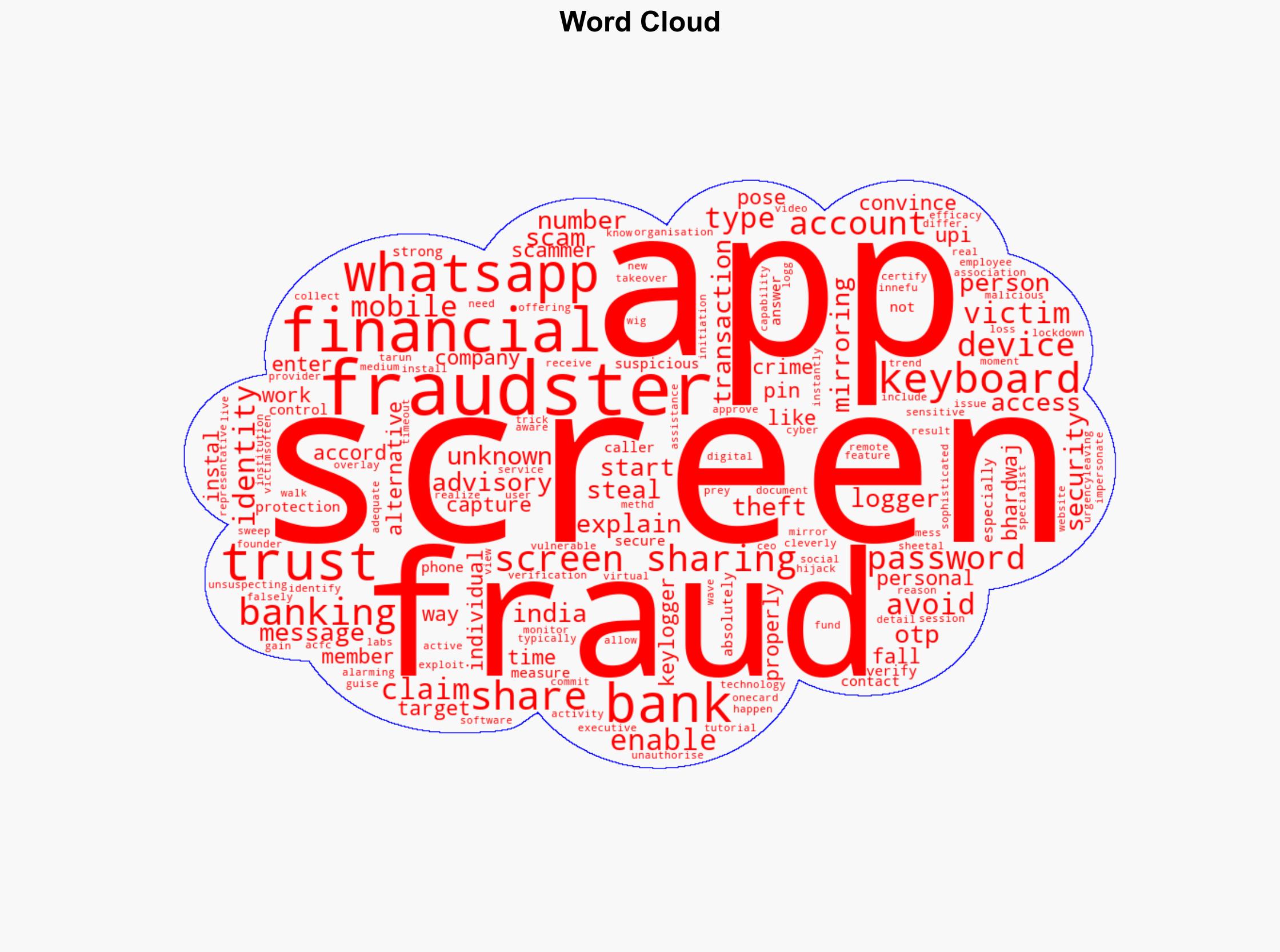

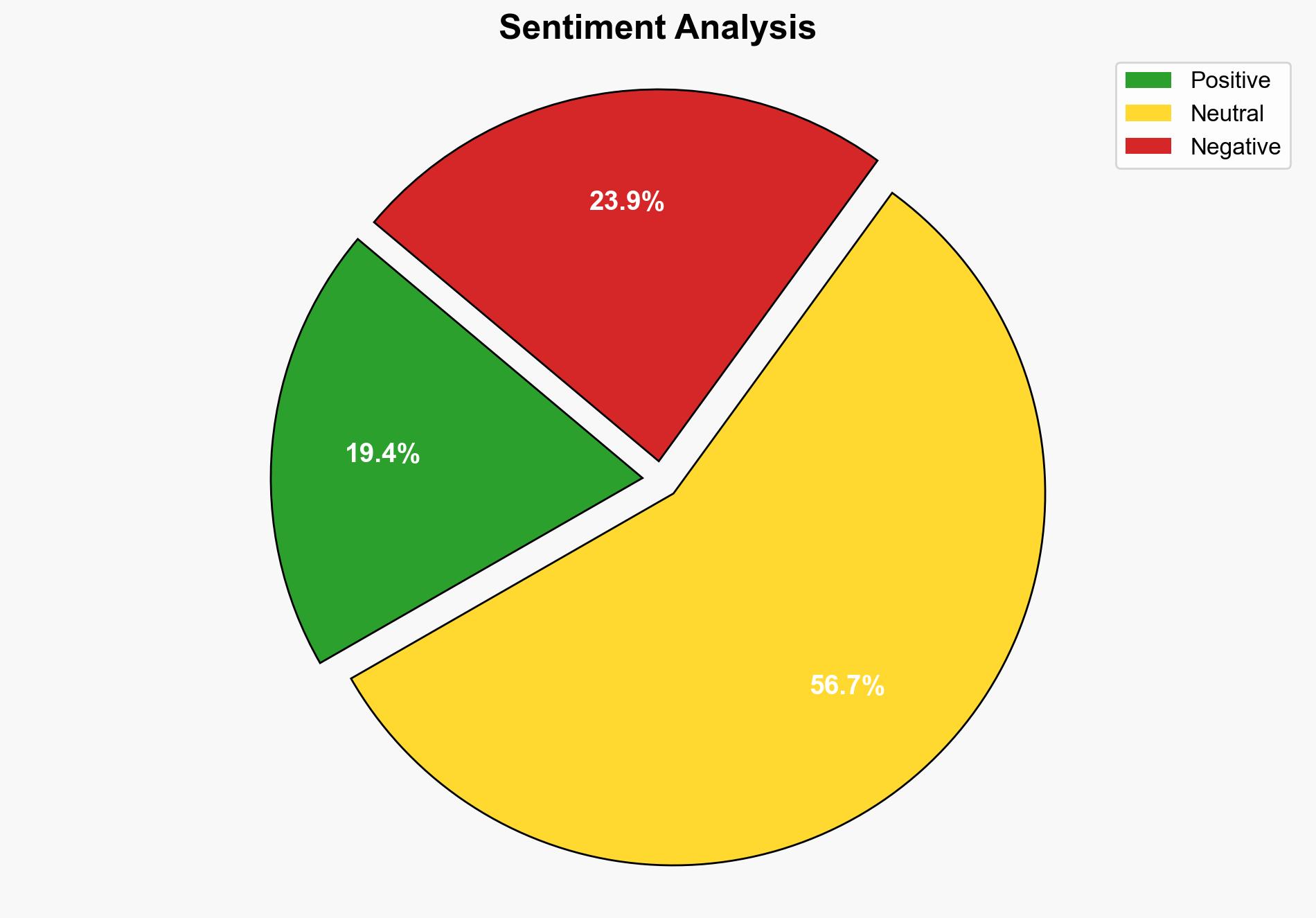

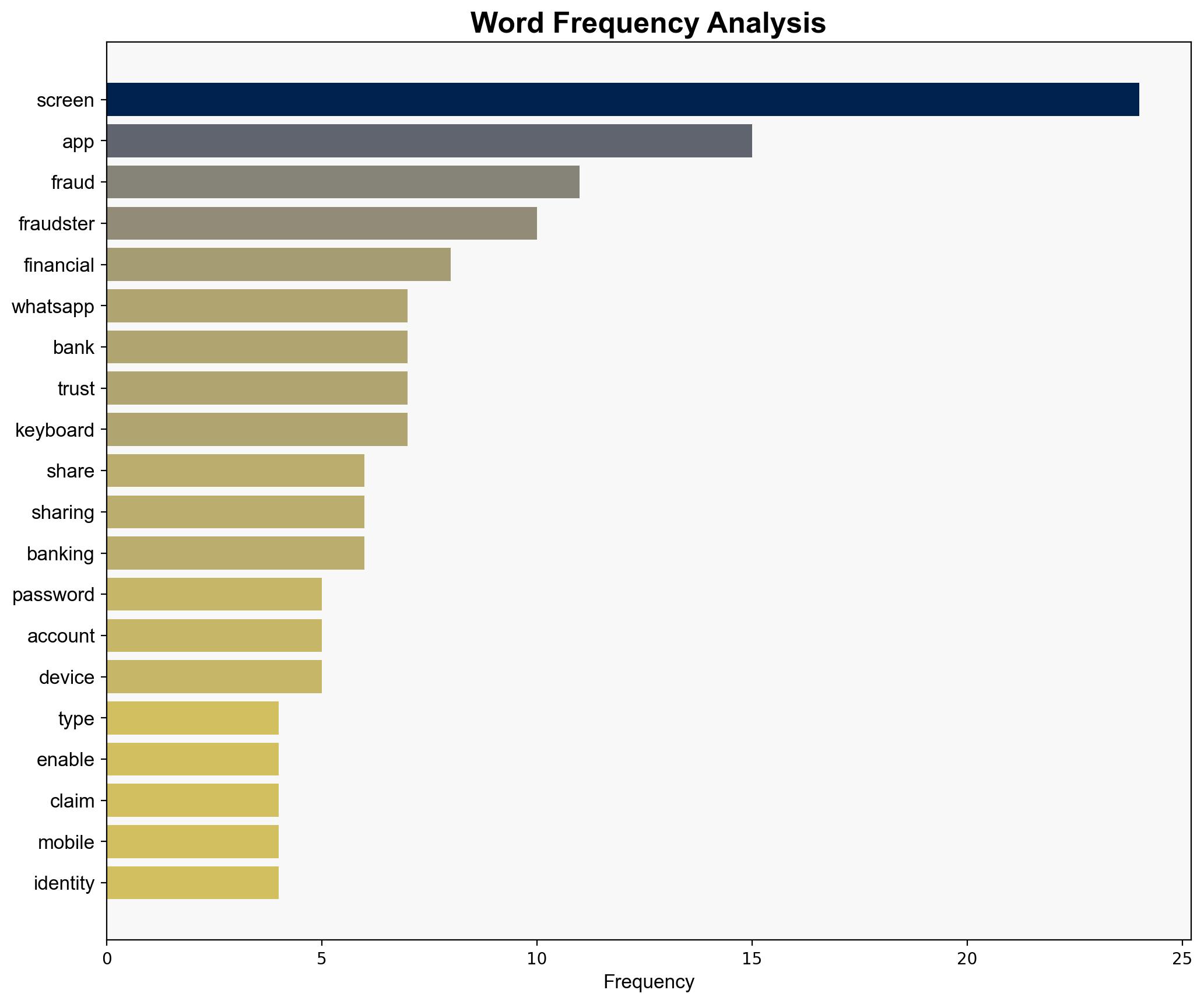

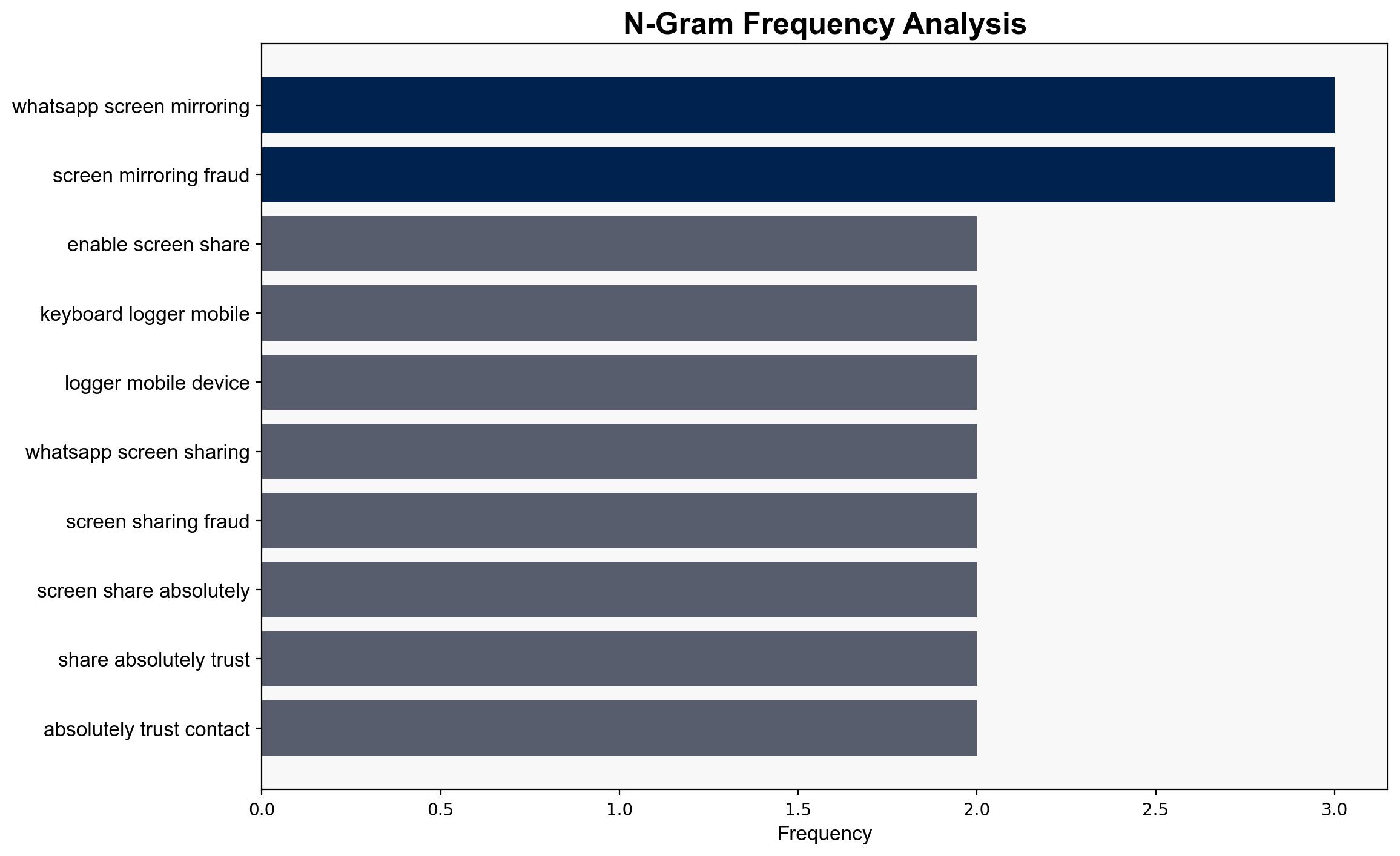

The most supported hypothesis is that the WhatsApp screen mirroring fraud is primarily a sophisticated social engineering attack exploiting trust in technology and institutions. Confidence level: High. Recommended action: Increase public awareness and enhance app-level security measures to prevent unauthorized screen sharing and keylogging.

2. Competing Hypotheses

1. **Hypothesis A**: The fraud is primarily a social engineering attack where fraudsters exploit victims’ trust in financial institutions to gain unauthorized access to sensitive information via screen mirroring apps.

2. **Hypothesis B**: The fraud is mainly a technical vulnerability exploitation, where fraudsters use malware and keyloggers to capture sensitive information without the need for social engineering.

Using ACH 2.0, Hypothesis A is better supported due to the detailed description of social engineering tactics employed by fraudsters, such as posing as trusted representatives and guiding victims through enabling screen sharing.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that victims lack awareness of screen mirroring risks and that financial institutions are not adequately educating customers.

– **Red Flags**: The source does not provide specific data on the prevalence of such frauds or the effectiveness of current countermeasures.

– **Blind Spots**: Potential underestimation of the technical sophistication of fraudsters and the role of malware in these attacks.

4. Implications and Strategic Risks

The fraud poses significant risks to financial security and personal identity, potentially leading to widespread economic impacts if not addressed. The psychological dimension includes erosion of trust in digital financial services. Escalation could involve more sophisticated attacks targeting other communication platforms.

5. Recommendations and Outlook

- **Mitigation**: Launch public awareness campaigns emphasizing the dangers of screen sharing and the importance of verifying caller identities.

- **Security Enhancements**: Encourage financial apps to integrate stronger security features, such as automatic detection and blocking of screen sharing.

- **Scenario Projections**:

– **Best Case**: Increased awareness and improved security measures lead to a significant reduction in fraud incidents.

– **Worst Case**: Fraudsters adapt quickly, leading to more sophisticated attacks and increased financial losses.

– **Most Likely**: Gradual improvement in security and awareness, with periodic spikes in fraud attempts as tactics evolve.

6. Key Individuals and Entities

Sheetal Bhardwaj, Tarun Wig

7. Thematic Tags

national security threats, cybersecurity, financial fraud, digital trust