What’s Working for YC Companies Since the AI Boom – Substack.com

Published on: 2025-05-30

Intelligence Report: What’s Working for YC Companies Since the AI Boom – Substack.com

1. BLUF (Bottom Line Up Front)

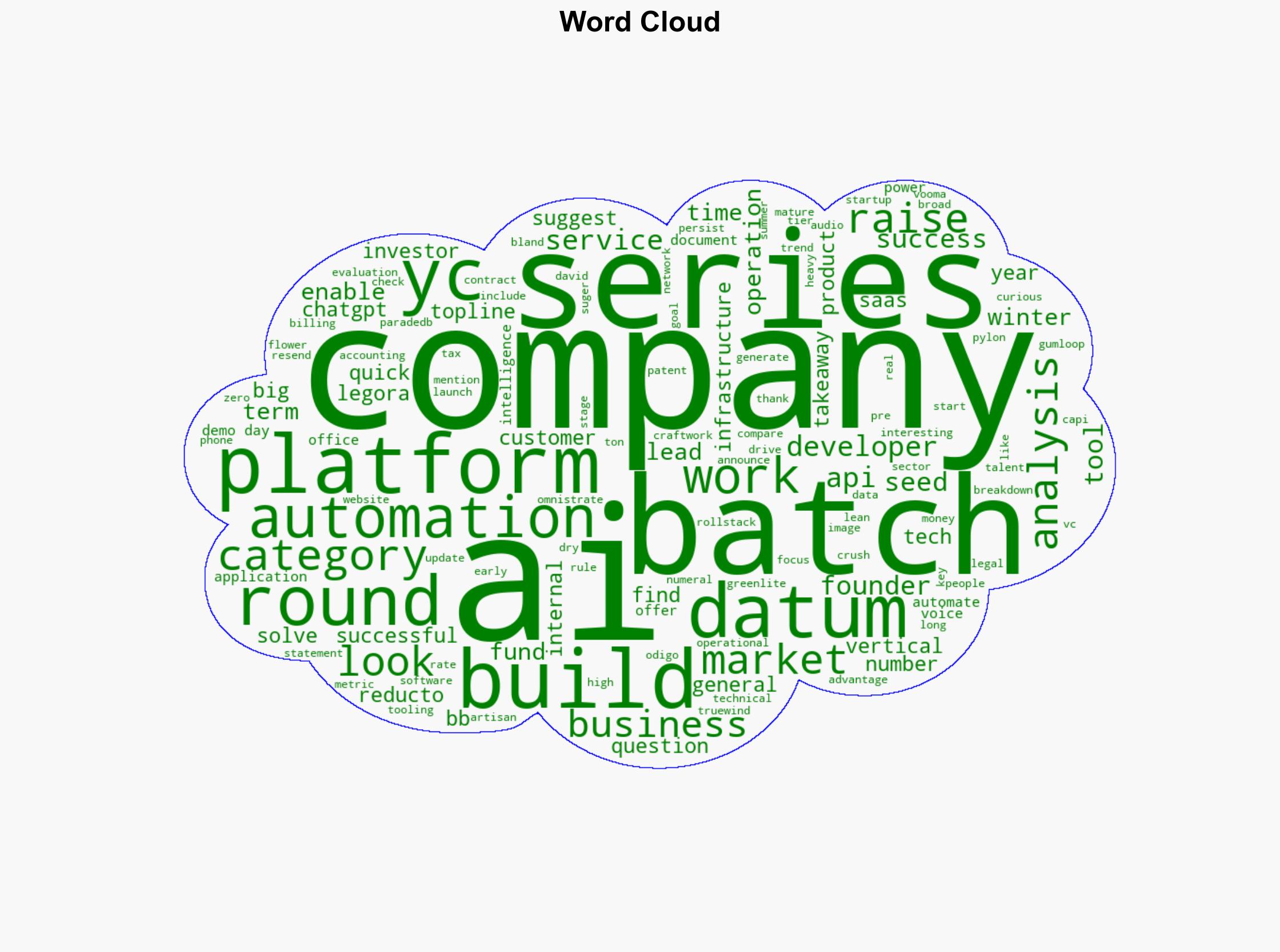

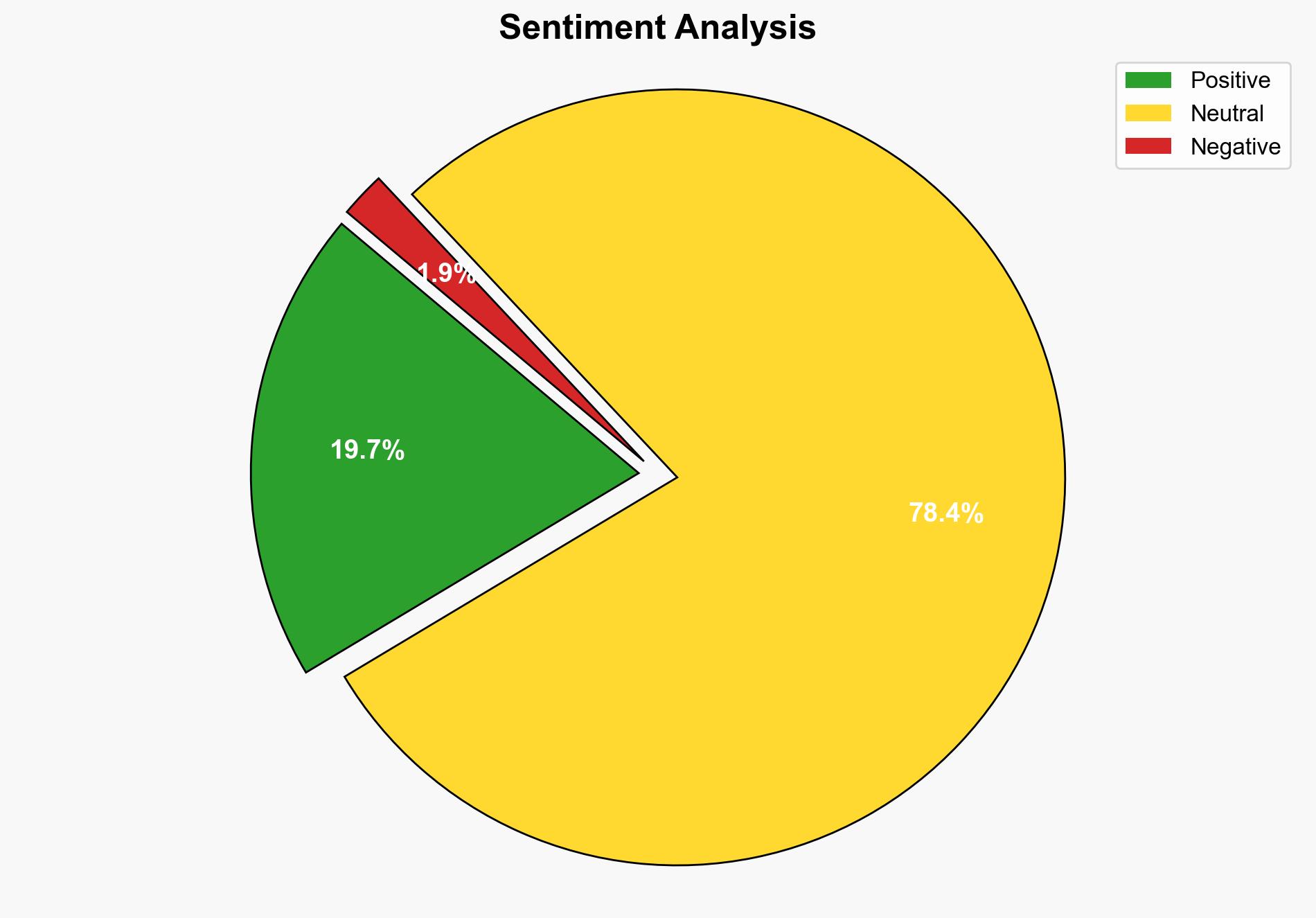

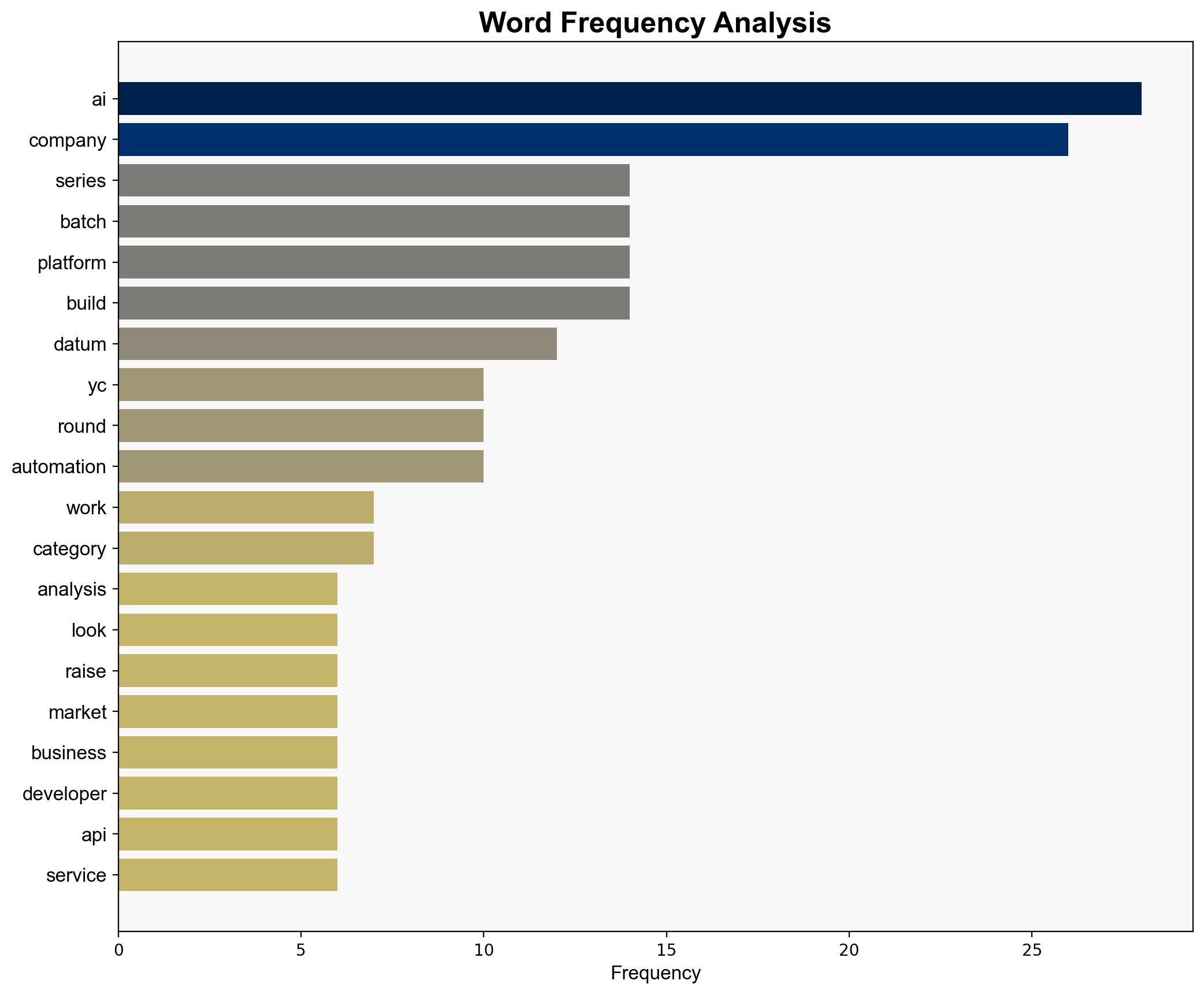

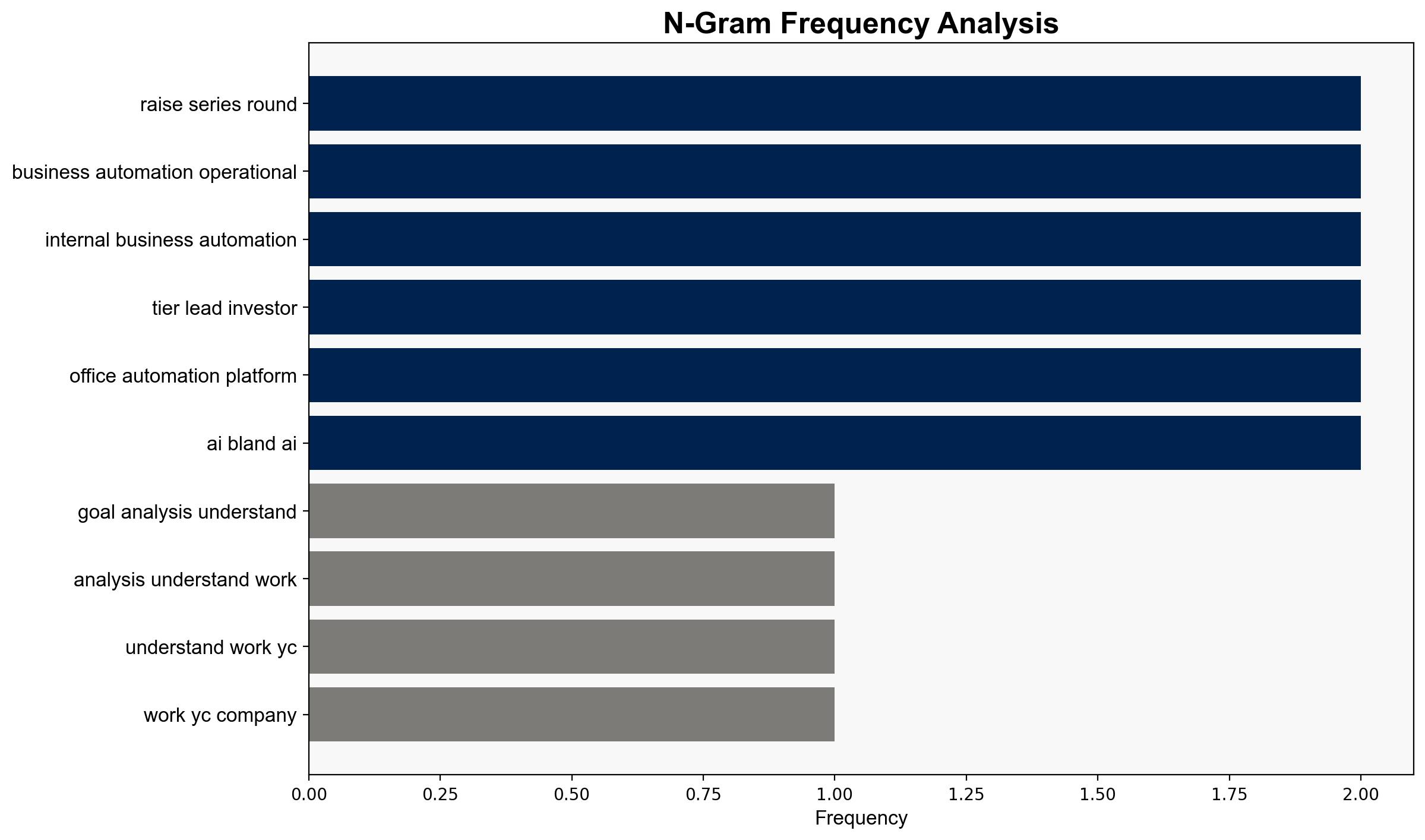

The analysis of YC companies post-AI boom reveals a strategic focus on business automation and operational tooling, with a notable success in internal business platforms. Despite the hype surrounding AI, the most successful companies are those leveraging automation and infrastructure optimization. The absence of consumer hardware and deep tech in successful Series A rounds suggests a strategic pivot towards software and platform-based solutions. Recommendations include leveraging these trends for strategic investments and partnerships.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Adversarial Threat Simulation

While not directly applicable to YC companies, understanding potential competitive threats can inform strategic positioning and resilience building.

Indicators Development

Monitoring investment patterns and technological adoption rates can provide early indicators of market shifts and competitive advantages.

Bayesian Scenario Modeling

Probabilistic modeling suggests a high likelihood of continued success for companies focusing on B2B SaaS and automation, with potential risks in over-reliance on AI-specific verticals.

Network Influence Mapping

Mapping relationships within the YC network highlights the importance of technical talent and founder networks in driving company success.

3. Implications and Strategic Risks

The dominance of automation and operational tooling suggests a shift in market demand that could impact traditional tech sectors. The lack of consumer hardware success may indicate a broader market trend away from hardware-intensive solutions. Strategic risks include potential market saturation in AI-specific verticals and the need for continuous innovation to maintain competitive advantage.

4. Recommendations and Outlook

- Invest in companies focusing on B2B SaaS and automation platforms to capitalize on current market trends.

- Monitor emerging AI verticals for potential over-saturation and adjust investment strategies accordingly.

- Scenario-based projections suggest a best-case scenario of sustained growth in automation sectors, a worst-case scenario of market saturation, and a most likely scenario of moderate growth with strategic pivots.

5. Key Individuals and Entities

Notable entities include Deel and Brex, which exemplify successful business automation platforms. David AI is highlighted for its impressive Series A round success.

6. Thematic Tags

business automation, AI boom, YC companies, strategic investment, market trends