Why are stocks falling and what should investors do Experts explain – ABC News

Published on: 2025-11-17

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Analysis of Stock Market Decline and Strategic Recommendations for Investors

1. BLUF (Bottom Line Up Front)

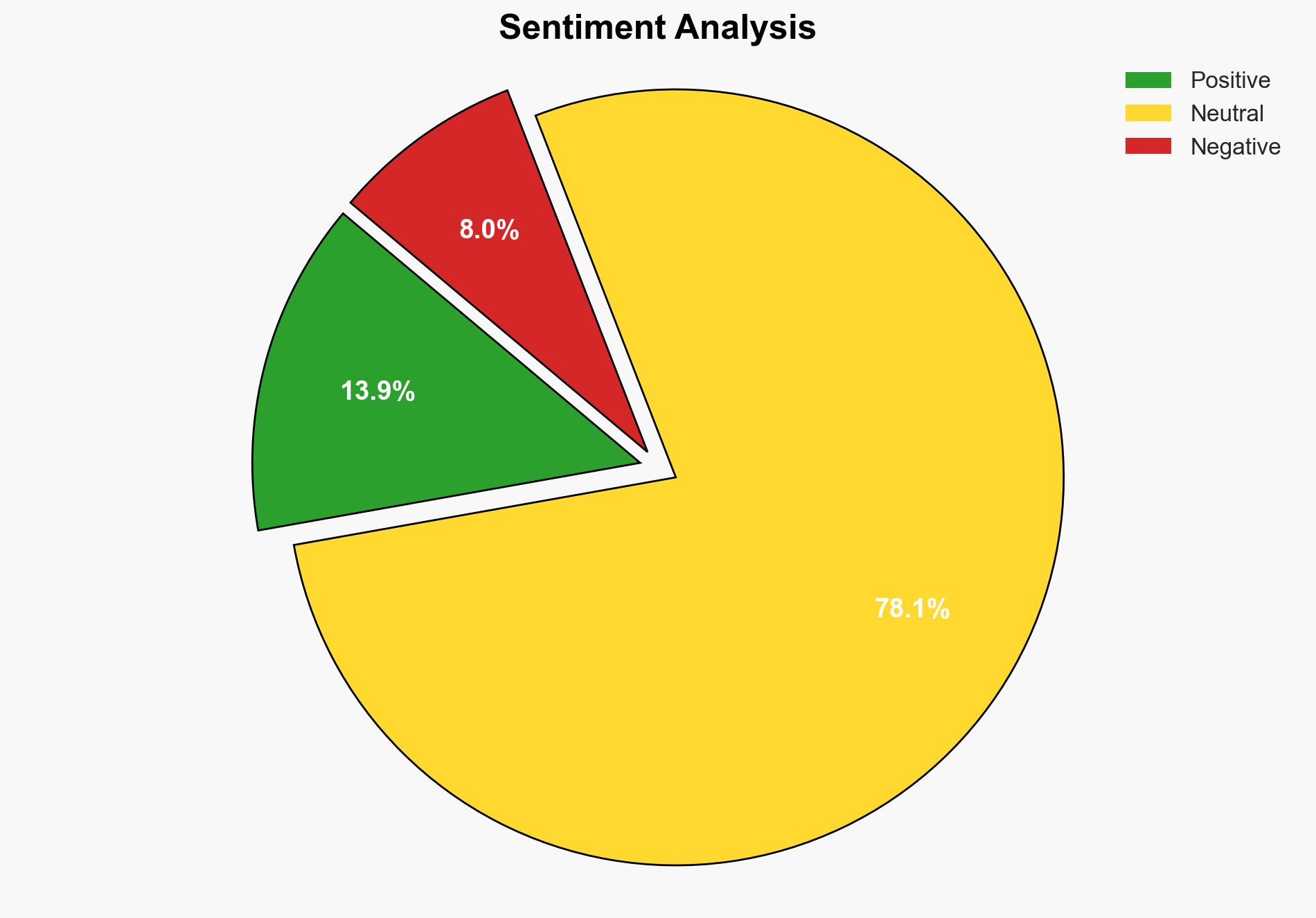

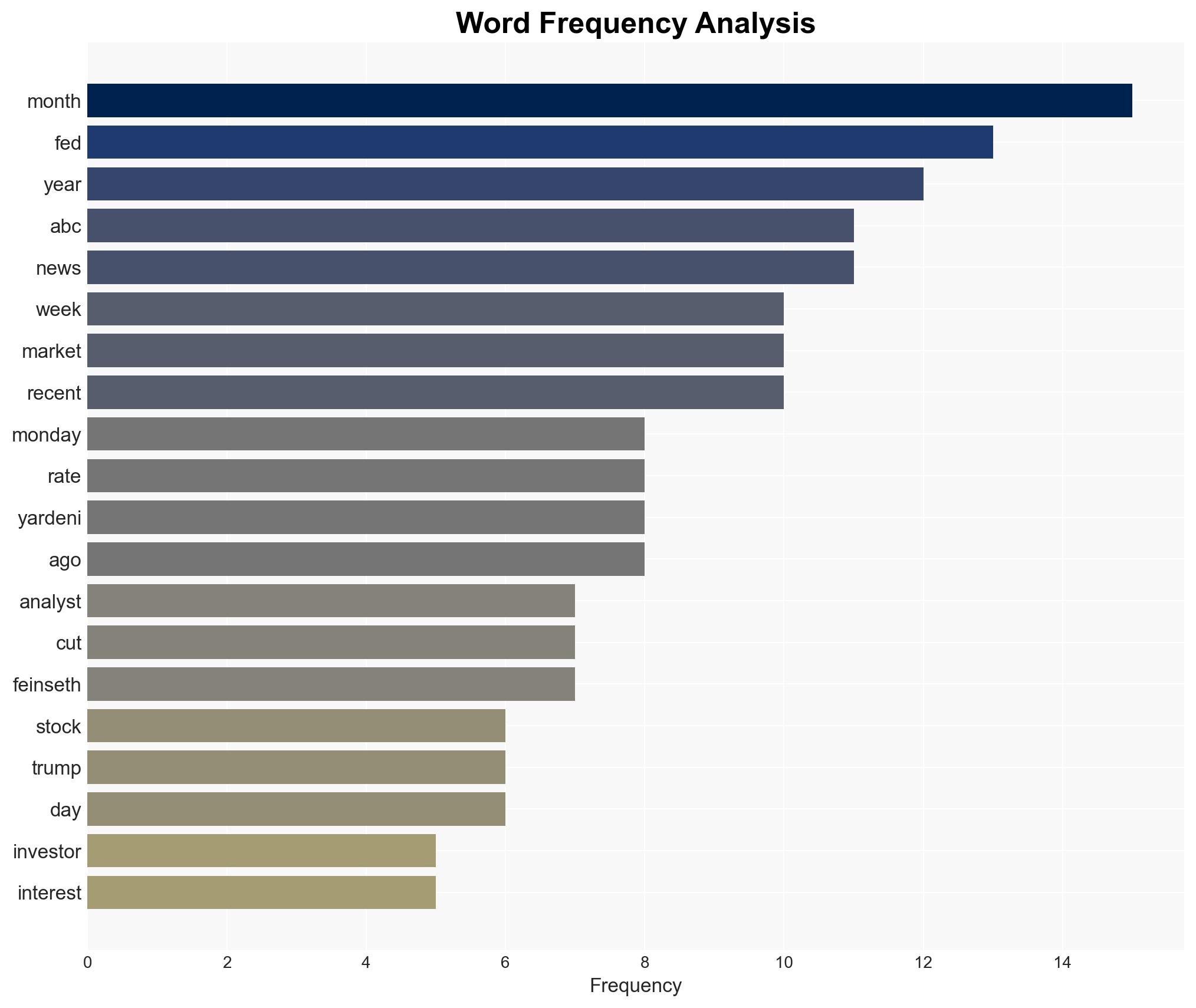

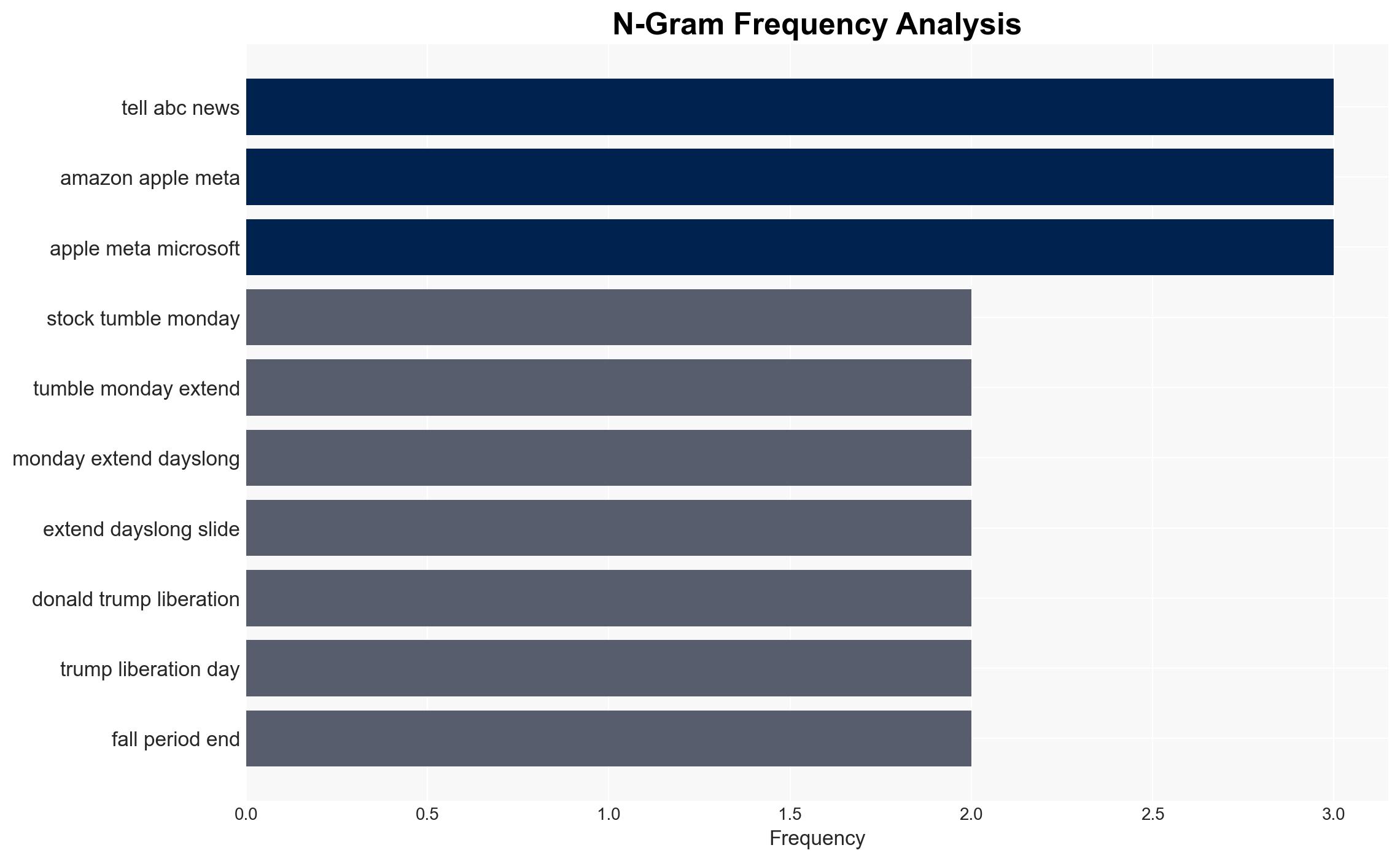

The recent decline in stock markets is primarily driven by investor skepticism regarding the sustainability of tech-driven market rallies and the Federal Reserve’s interest rate policies. With a moderate confidence level, the most supported hypothesis is that the downturn is a temporary correction rather than a sustained bear market. Investors should cautiously monitor economic indicators and Federal Reserve announcements, while considering diversification to mitigate risks.

2. Competing Hypotheses

Hypothesis 1: The stock market decline is a temporary correction due to overvaluation in tech stocks and recalibration of interest rate expectations. This hypothesis is supported by the concentration of market gains in a few tech giants and the market’s reaction to Federal Reserve interest rate projections.

Hypothesis 2: The decline marks the beginning of a sustained downturn driven by broader economic weaknesses and geopolitical uncertainties. This perspective considers the potential impact of ongoing inflation, geopolitical tensions, and policy shifts.

Hypothesis 1 is more likely given the historical resilience of the market to similar corrections and the lack of widespread economic indicators pointing to a recession.

3. Key Assumptions and Red Flags

Assumptions: The analysis assumes that current economic indicators such as employment rates and GDP growth remain stable. It also presumes that Federal Reserve policies will not drastically deviate from current projections.

Red Flags: Potential red flags include unexpected geopolitical developments, significant policy changes by the Federal Reserve, or unforeseen economic data that could alter market sentiment.

4. Implications and Strategic Risks

The primary risk is economic, with potential for increased volatility if inflation persists or if interest rate hikes are more aggressive than anticipated. Politically, any major policy shifts or geopolitical tensions could exacerbate market instability. Cybersecurity threats to financial institutions could also pose significant risks, potentially impacting investor confidence and market operations.

5. Recommendations and Outlook

- Actionable Steps: Investors should diversify portfolios to reduce exposure to tech-heavy stocks and consider hedging strategies to protect against interest rate fluctuations.

- Best Scenario: The market stabilizes as tech valuations adjust and the Federal Reserve maintains a balanced approach to interest rates.

- Worst Scenario: A combination of persistent inflation, aggressive rate hikes, and geopolitical tensions leads to a prolonged bear market.

- Most-likely Scenario: A temporary market correction followed by gradual recovery as economic fundamentals remain strong.

6. Key Individuals and Entities

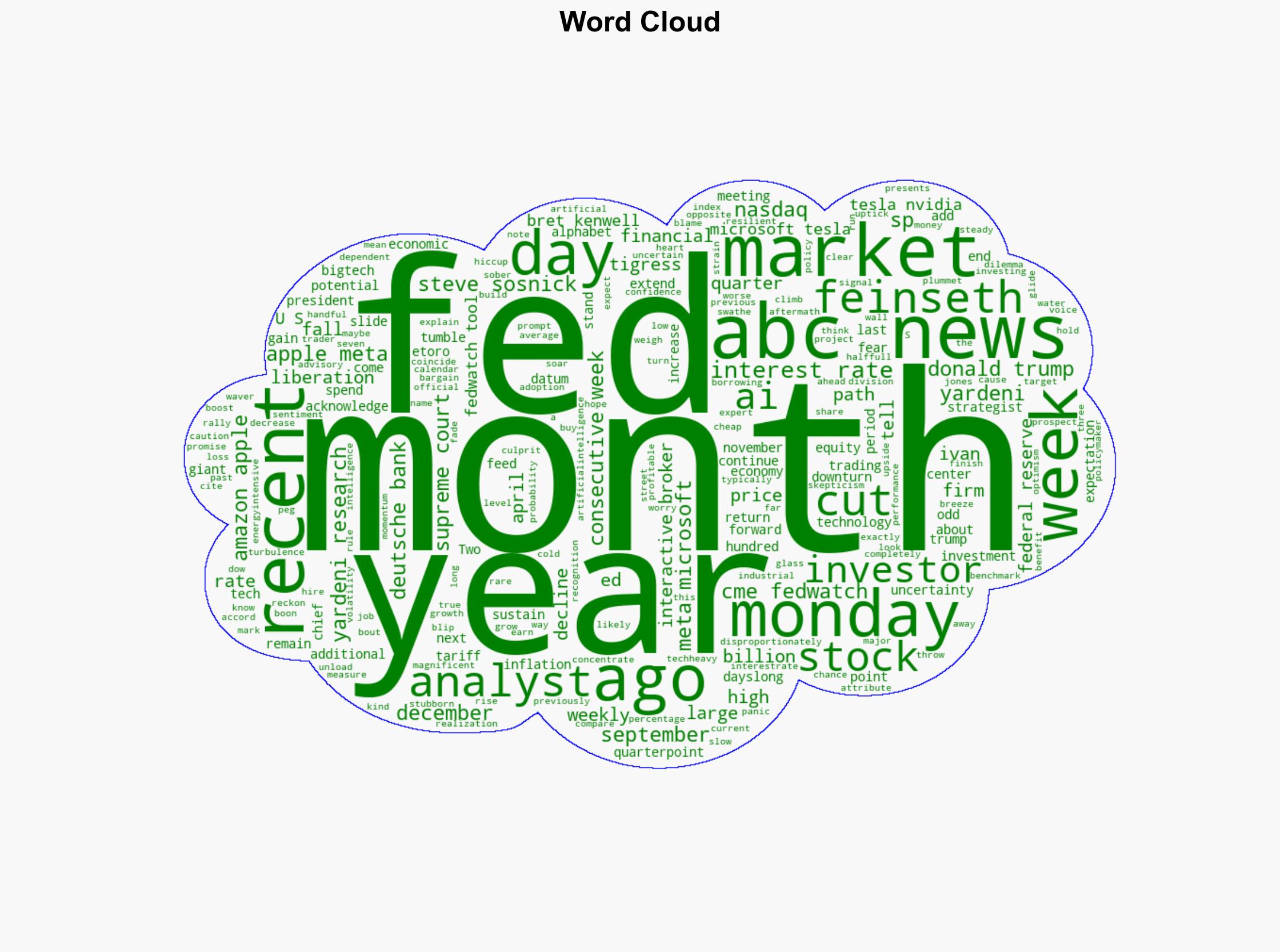

Steve Sosnick, Ed Yardeni, Ivan Feinseth, Bret Kenwell, Deutsche Bank, Interactive Brokers, Yardeni Research, Tigress Financial, eToro.

7. Thematic Tags

Cybersecurity, Economic Volatility, Federal Reserve Policy, Technology Sector, Market Correction, Investor Strategy

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us

·