Why everyone is suddenly so interested in US bond markets – BBC News

Published on: 2025-04-19

Intelligence Report: Why Everyone is Suddenly So Interested in US Bond Markets

1. BLUF (Bottom Line Up Front)

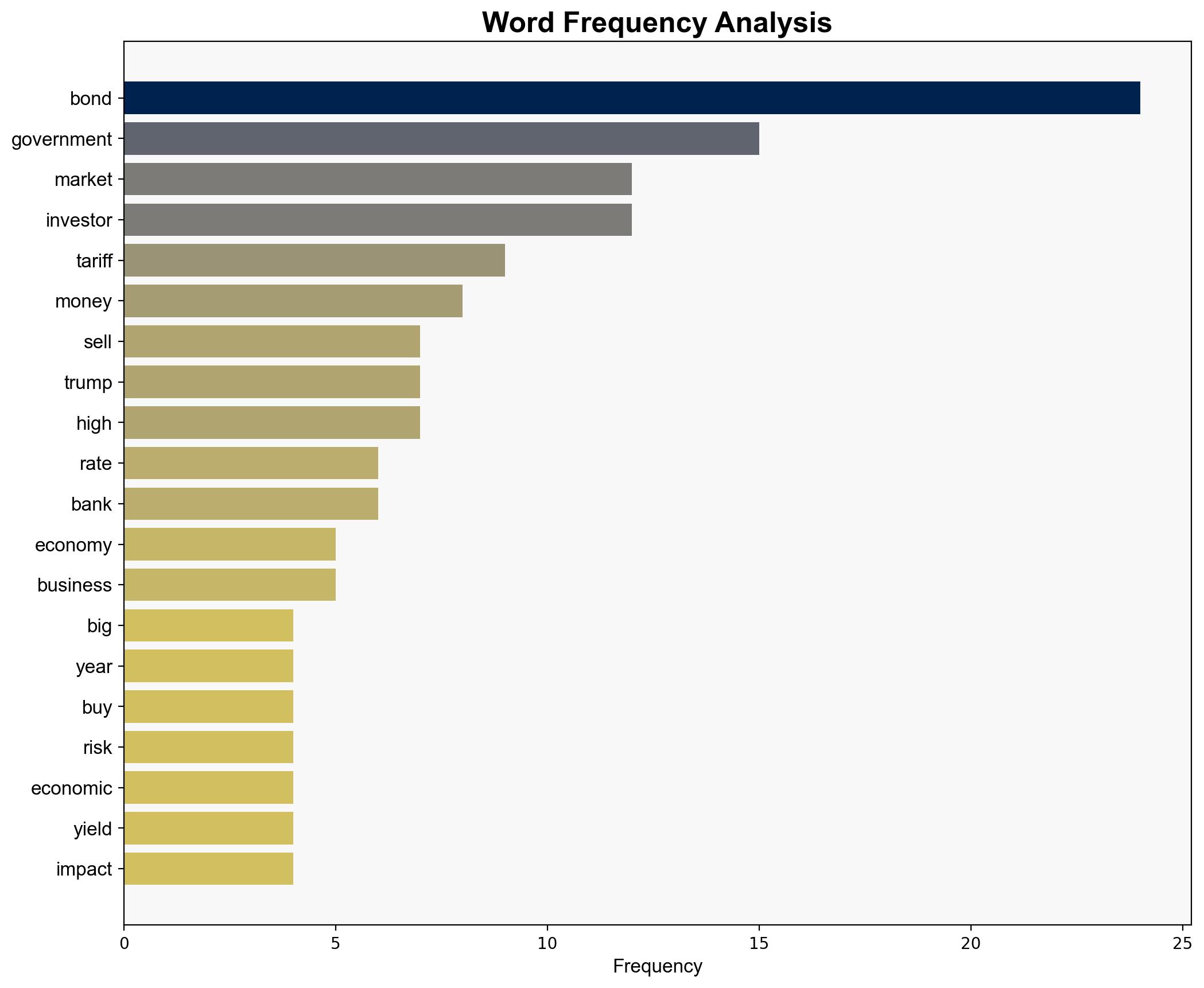

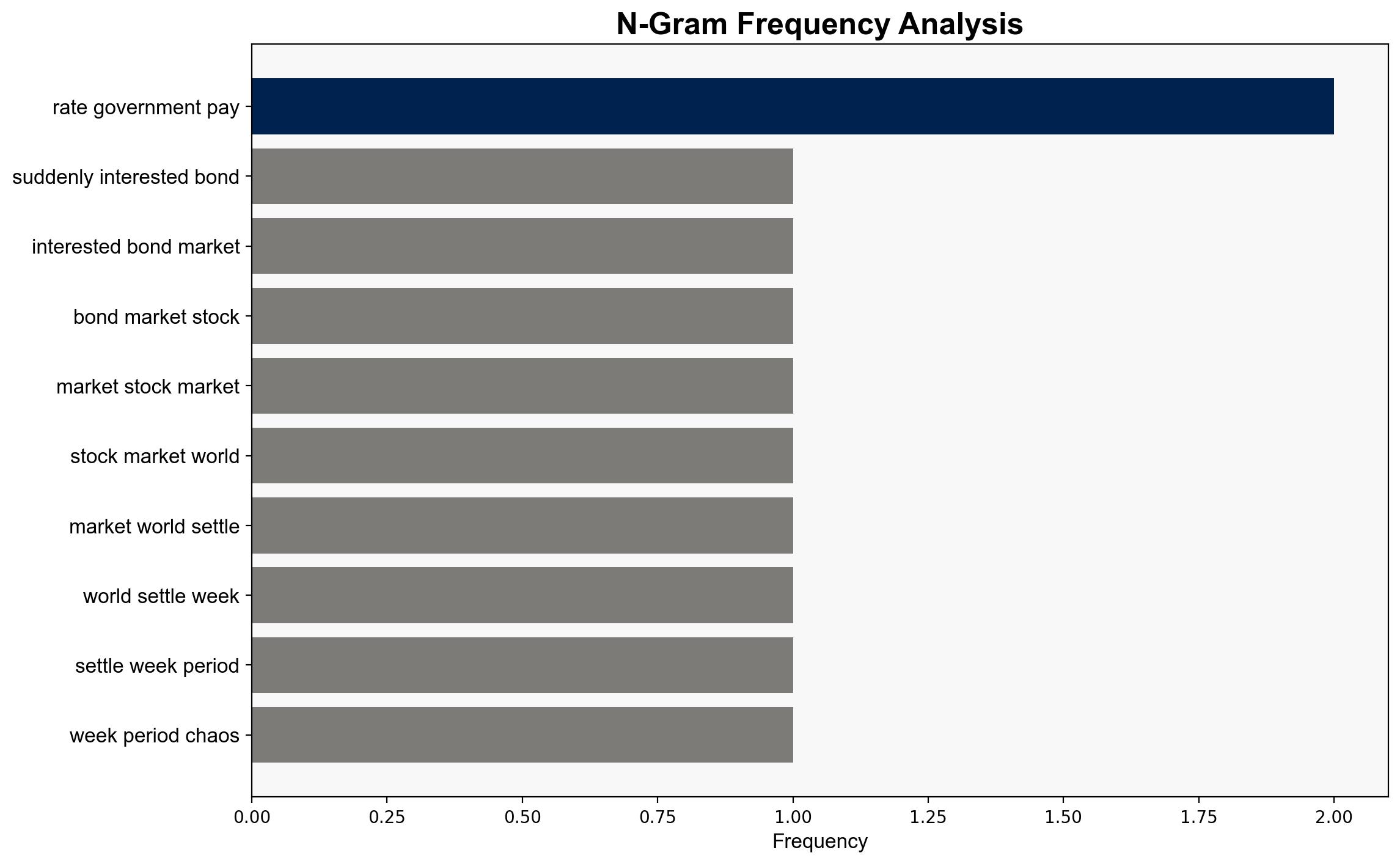

The recent volatility in the US bond market, characterized by a sharp increase in yields, signals a significant shift in investor confidence due to uncertainty surrounding US trade tariffs. This development poses potential risks to the US economy, impacting public spending and potentially influencing policy decisions. It is crucial for decision-makers to monitor these trends and consider strategic adjustments to mitigate economic repercussions.

2. Detailed Analysis

The following structured analytic techniques have been applied:

SWOT Analysis

Strengths: US bonds are traditionally seen as a secure investment, backed by the economic strength of the US.

Weaknesses: Current market volatility undermines the perceived safety of US bonds.

Opportunities: Potential for policy adjustments to stabilize markets and restore investor confidence.

Threats: Prolonged uncertainty could lead to increased borrowing costs and reduced public spending capacity.

Cross-Impact Matrix

The US bond market’s volatility could influence global markets, particularly in regions heavily invested in US securities. Neighboring economies may experience ripple effects, affecting their own financial stability and investment strategies.

Scenario Generation

Scenario 1: Continued volatility leads to increased borrowing costs, prompting a reevaluation of trade policies.

Scenario 2: Stabilization efforts succeed, restoring investor confidence and normalizing bond yields.

Scenario 3: Escalation of trade tensions exacerbates market instability, impacting global economic growth.

3. Implications and Strategic Risks

The current bond market trends highlight vulnerabilities in economic policy and investor sentiment. Rising yields may strain government budgets, affecting public services and economic growth. Additionally, the situation underscores the interconnectedness of global markets, where US policy shifts can have widespread implications.

4. Recommendations and Outlook

- Monitor bond market trends closely to anticipate further shifts in investor behavior.

- Consider policy adjustments to address market volatility and restore confidence.

- Engage in international dialogue to mitigate global economic impacts and foster stability.

- Develop contingency plans for various scenarios, focusing on economic resilience and adaptability.

5. Key Individuals and Entities

John Canavan