Why gold may be losing its shine as a safe-haven investment – The Conversation Africa

Published on: 2025-08-22

Intelligence Report: Why gold may be losing its shine as a safe-haven investment – The Conversation Africa

1. BLUF (Bottom Line Up Front)

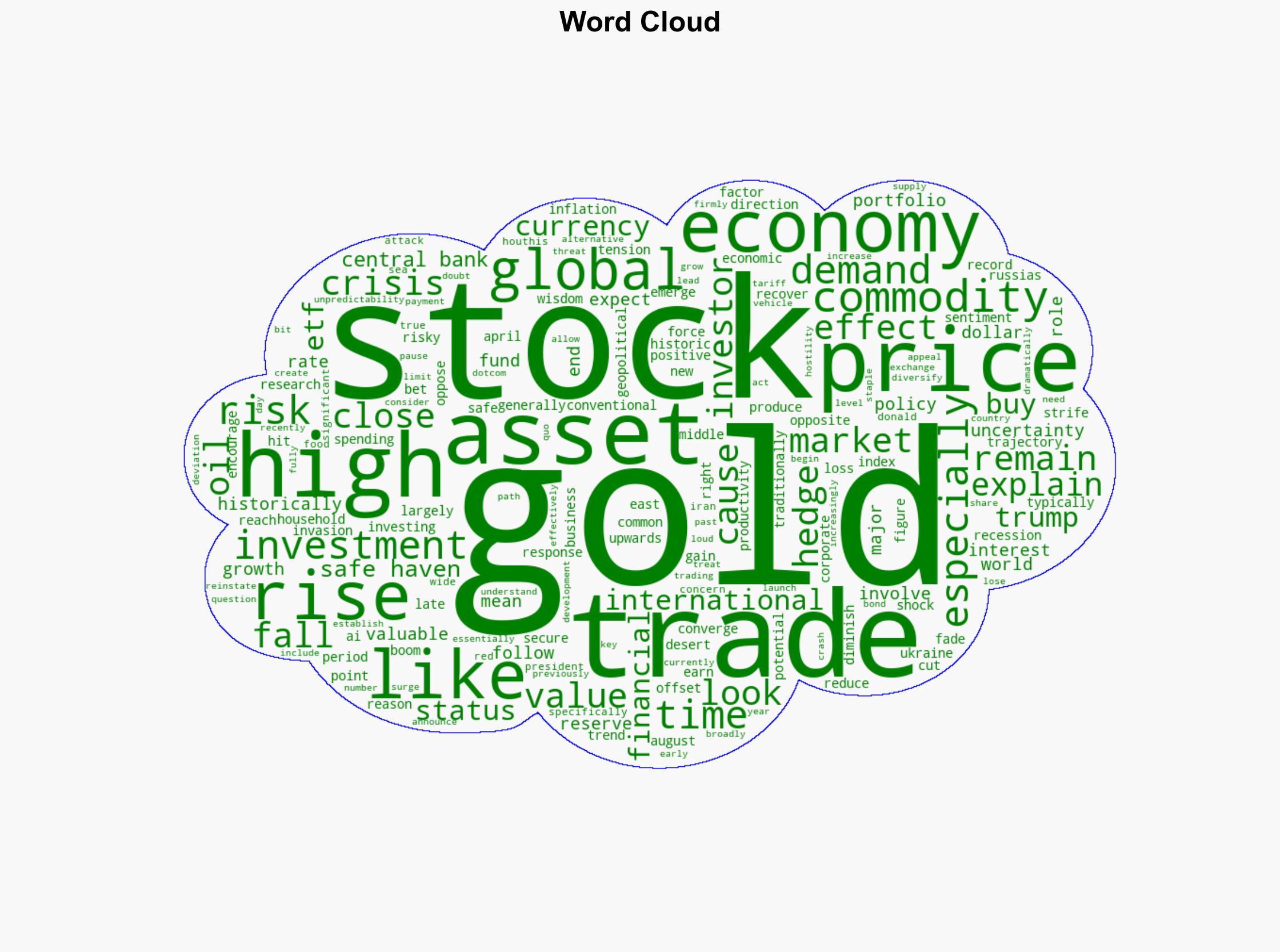

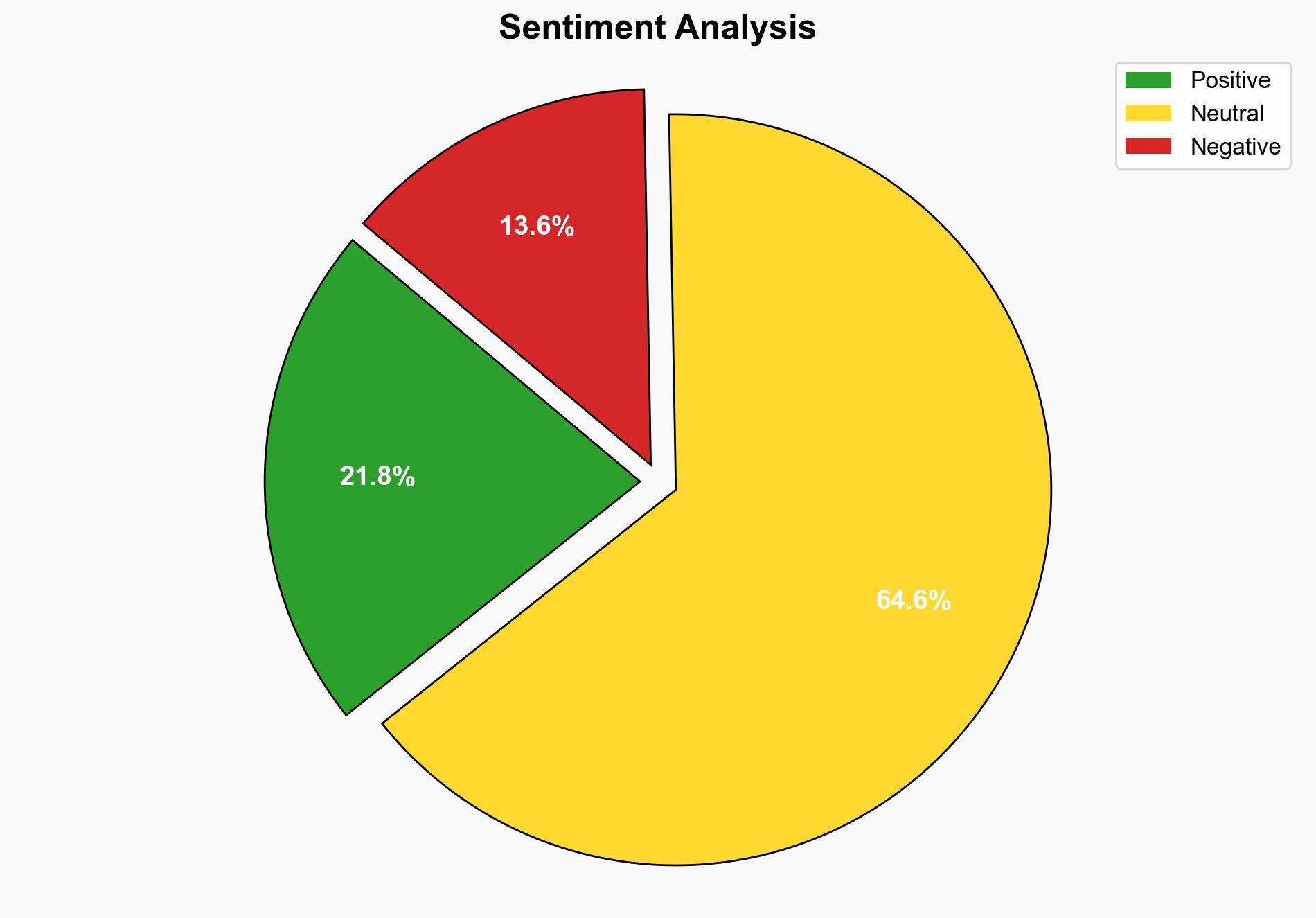

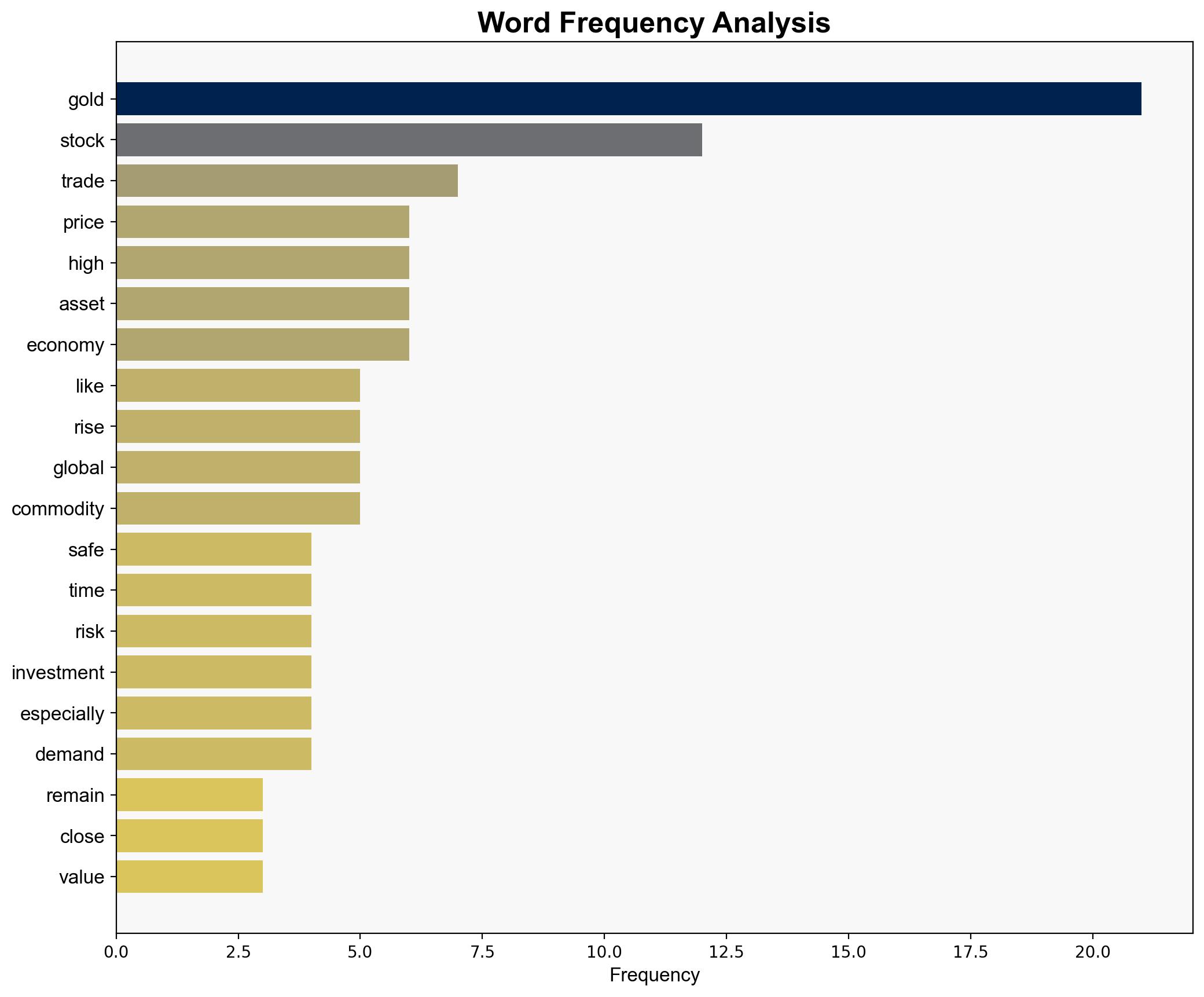

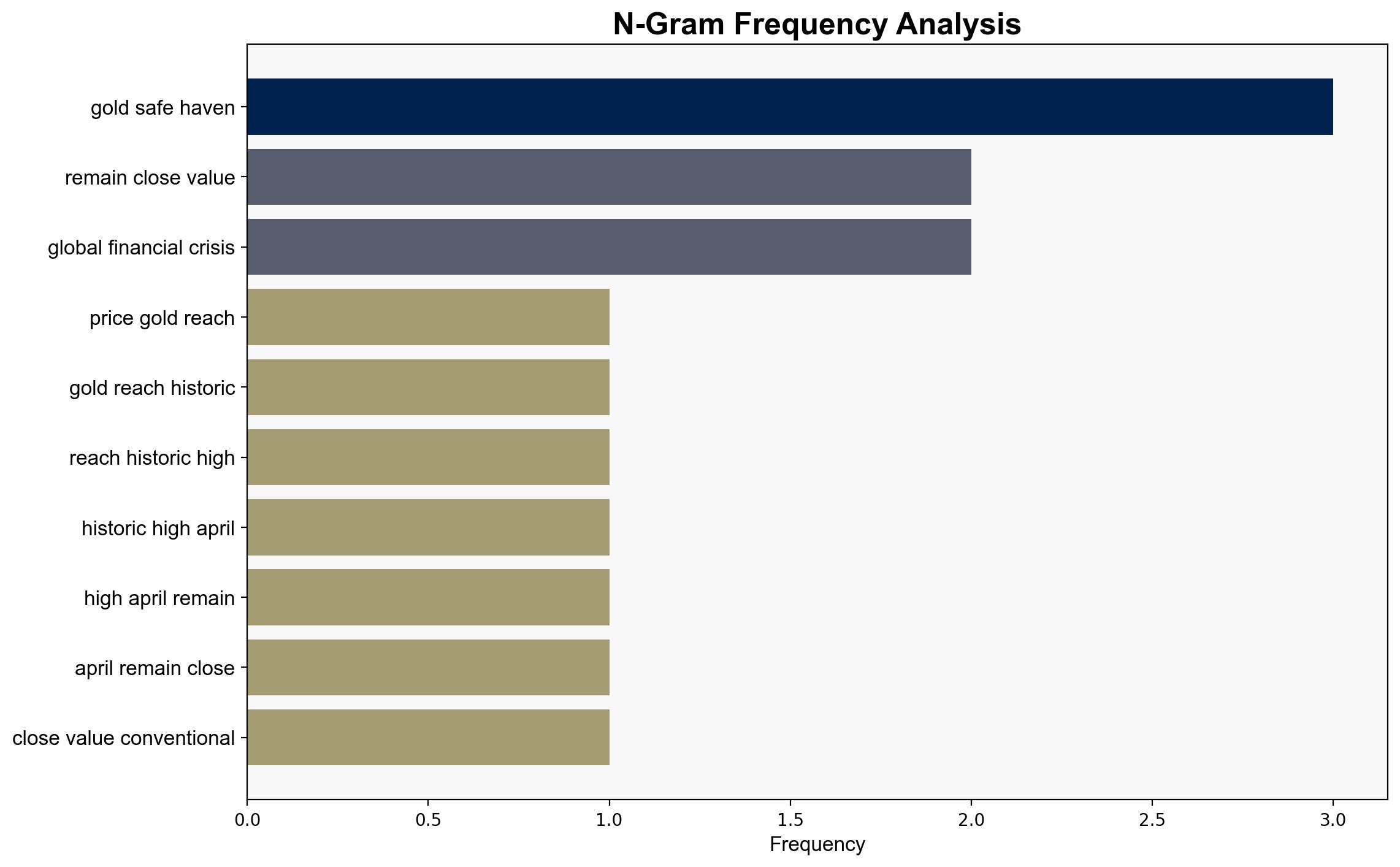

Gold’s status as a safe-haven investment is under scrutiny due to converging economic and geopolitical factors. The hypothesis that gold is losing its traditional role as a hedge against market volatility is better supported by current trends. Confidence Level: Moderate. Recommended action includes diversifying investment strategies and monitoring geopolitical developments closely.

2. Competing Hypotheses

1. **Gold is losing its safe-haven status**: This hypothesis suggests that gold’s traditional role as a hedge against economic uncertainty is diminishing due to rising stock markets, high inflation, and the increasing role of alternative investments like ETFs.

2. **Gold remains a safe-haven asset**: This hypothesis posits that despite current trends, gold will continue to serve as a reliable hedge against geopolitical risks and economic instability, driven by its intrinsic value and limited supply.

3. Key Assumptions and Red Flags

– **Assumptions**:

– The assumption that rising stock markets and economic recovery diminish the need for gold as a hedge.

– The belief that geopolitical tensions will not escalate to levels that significantly impact global markets.

– **Red Flags**:

– Potential underestimation of geopolitical risks, such as tensions involving Russia and the Middle East.

– Over-reliance on economic indicators without considering sudden market shocks.

4. Implications and Strategic Risks

– **Economic Risks**: A shift away from gold could lead to increased volatility in markets traditionally reliant on gold as a stabilizing asset.

– **Geopolitical Risks**: Escalating tensions in regions like the Middle East could reverse current trends, reaffirming gold’s role as a safe haven.

– **Market Dynamics**: The rise of alternative investments like ETFs could permanently alter the investment landscape, reducing gold’s appeal.

5. Recommendations and Outlook

- **Diversification**: Investors should consider diversifying portfolios to include a mix of assets beyond traditional safe havens like gold.

- **Monitoring Geopolitical Developments**: Stay informed about geopolitical tensions that could impact global markets and influence gold’s value.

- **Scenario Projections**:

– **Best Case**: Geopolitical tensions ease, and economic growth stabilizes, reducing reliance on gold.

– **Worst Case**: Escalating conflicts lead to market instability, reaffirming gold’s safe-haven status.

– **Most Likely**: Continued economic recovery with periodic market corrections, maintaining moderate demand for gold.

6. Key Individuals and Entities

– No specific individuals are mentioned in the source text. The focus is on broader economic and geopolitical trends.

7. Thematic Tags

national security threats, economic stability, geopolitical tensions, investment strategies