Why golds historic rally is about more than just Trump – Al Jazeera English

Published on: 2025-10-08

Intelligence Report: Why gold’s historic rally is about more than just Trump – Al Jazeera English

1. BLUF (Bottom Line Up Front)

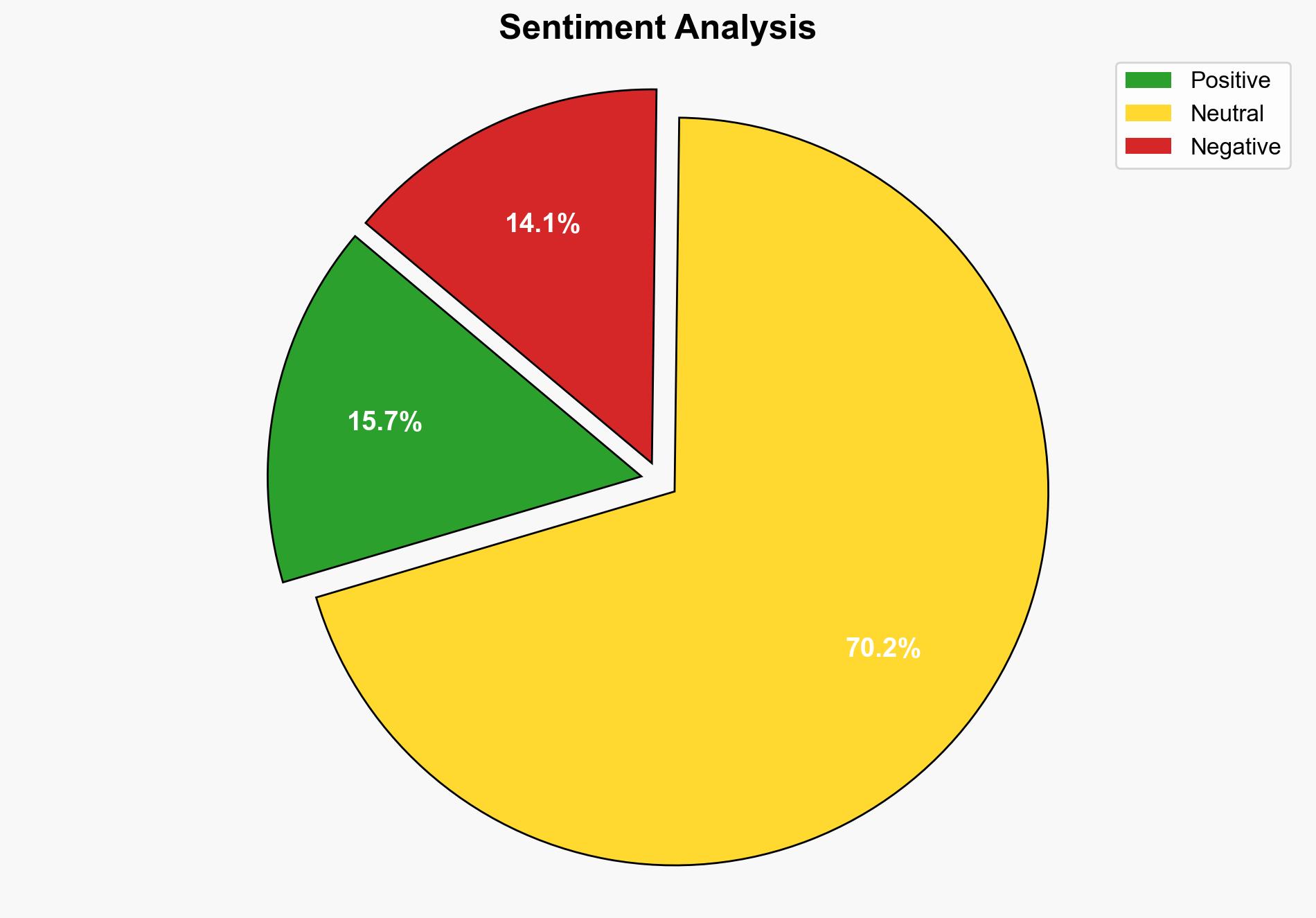

The historic rally in gold prices is influenced by a combination of global economic uncertainties and political developments, not solely by actions of the Trump administration. The hypothesis that broader geopolitical and economic factors are driving the rally is better supported. Confidence level: Moderate. Recommended action: Monitor geopolitical developments and economic indicators for potential impacts on gold markets.

2. Competing Hypotheses

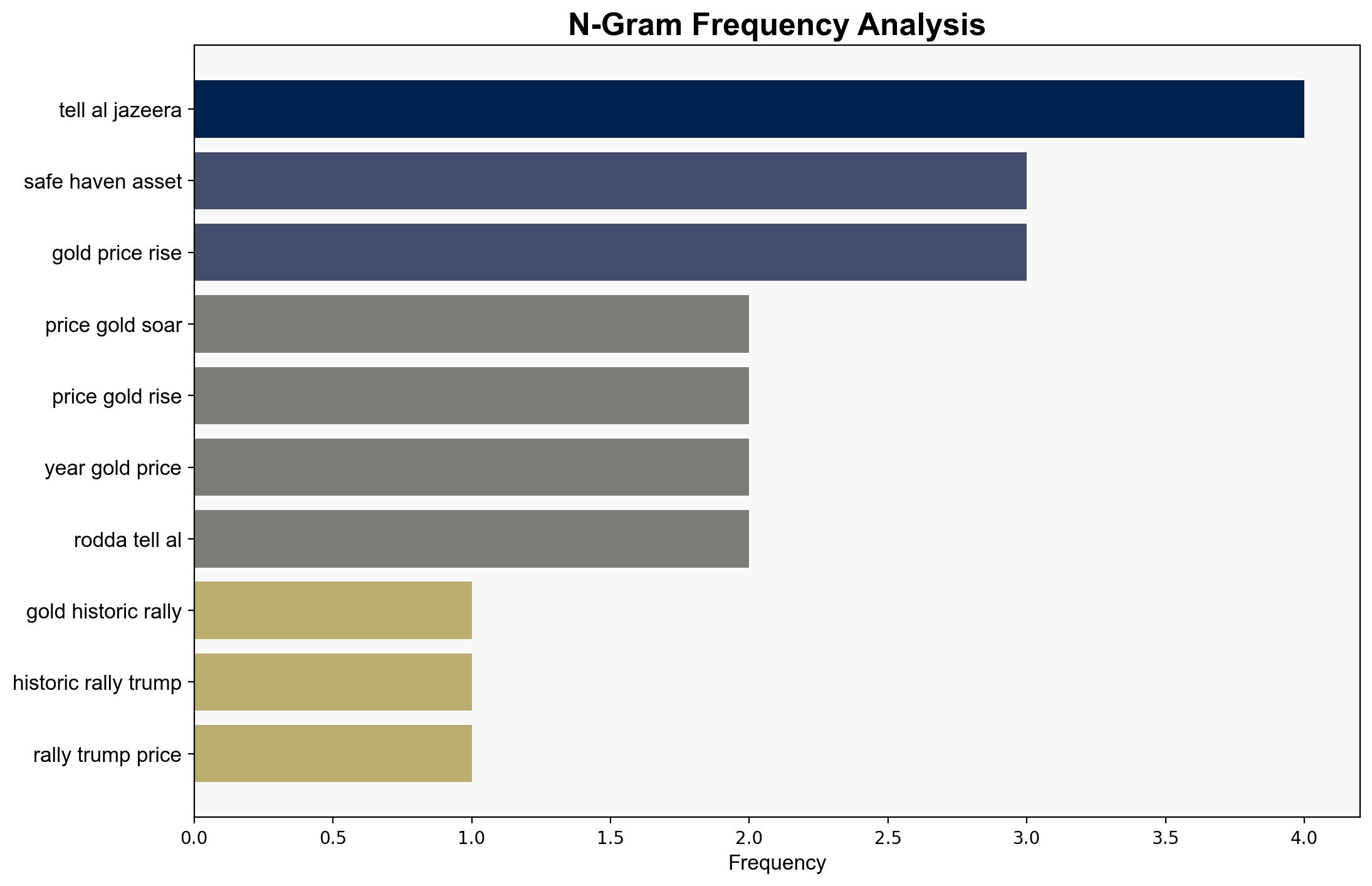

1. **Hypothesis A**: The rally in gold prices is primarily driven by the policies and political climate under President Trump, including trade wars and tensions with the Federal Reserve.

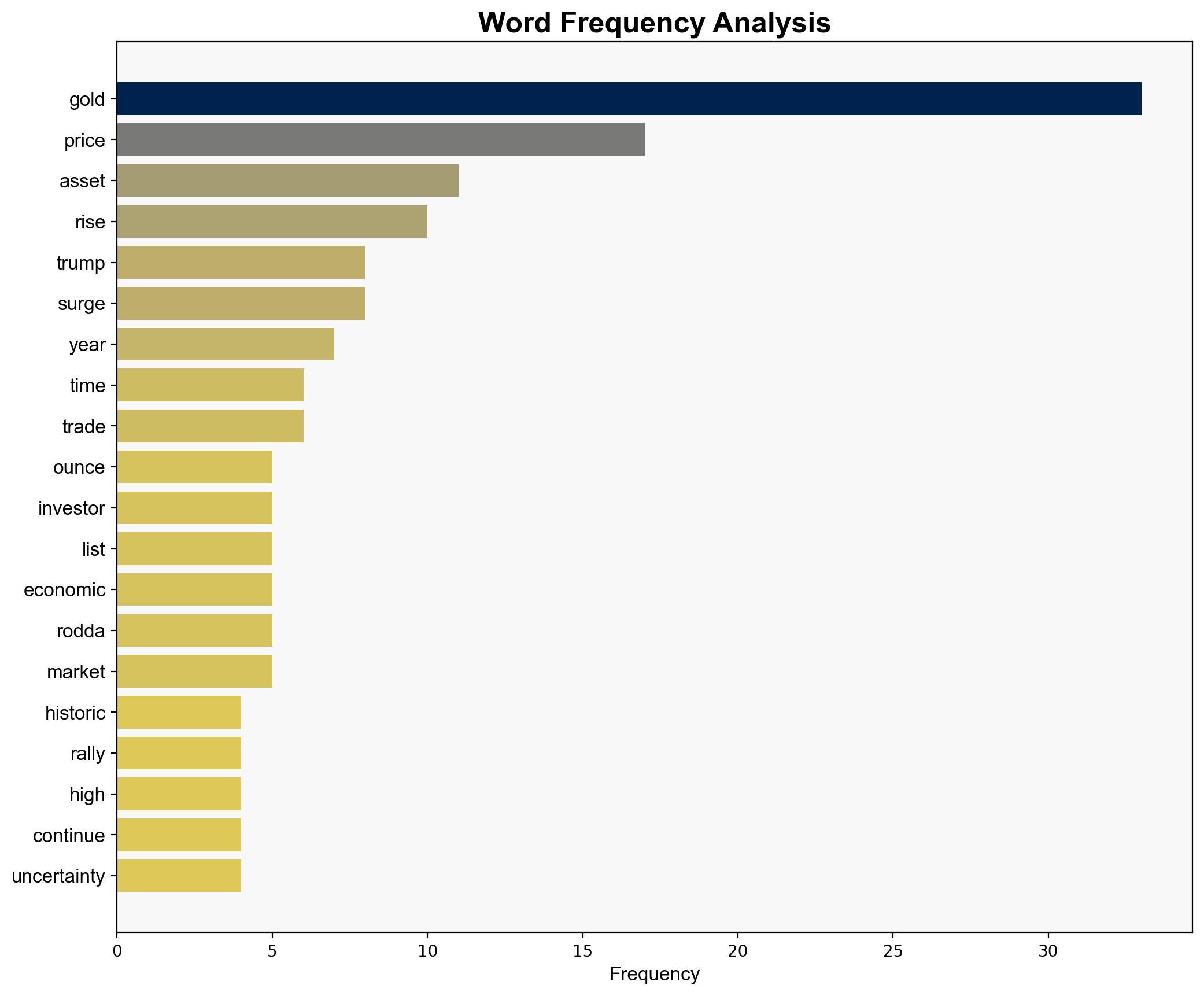

2. **Hypothesis B**: The rally is driven by a broader set of factors, including global economic uncertainties, political changes in countries like Japan, and historical patterns of gold as a safe haven during economic instability.

Using ACH 2.0, Hypothesis B is more likely. The evidence of global investor behavior, political changes in Japan, and historical trends of gold as a safe haven during economic uncertainty supports this hypothesis.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that gold’s role as a safe haven is universally accepted and that geopolitical tensions will continue to influence investor behavior.

– **Red Flags**: Over-reliance on historical patterns without considering new economic variables could mislead analysis. Potential bias in attributing too much influence to U.S. politics without considering global factors.

– **Missing Data**: Lack of detailed analysis on the impact of other commodities and currencies on gold prices.

4. Implications and Strategic Risks

– **Economic**: A continued rise in gold prices may indicate prolonged global economic uncertainty, affecting markets and investor confidence.

– **Geopolitical**: Political instability in major economies could exacerbate the rally, leading to shifts in global economic power dynamics.

– **Psychological**: Investor sentiment may increasingly favor gold, impacting stock markets and other investment vehicles.

5. Recommendations and Outlook

- Monitor geopolitical developments, especially in major economies like the U.S. and Japan, for potential impacts on gold markets.

- Scenario-based projections:

- **Best Case**: Stabilization of global politics leads to a gradual decline in gold prices.

- **Worst Case**: Escalation of geopolitical tensions causes a further surge in gold prices, destabilizing other markets.

- **Most Likely**: Continued moderate increase in gold prices as global uncertainties persist.

6. Key Individuals and Entities

– Donald Trump

– Sanae Takaichi

– Kyle Rodda

– Tim Waterer

7. Thematic Tags

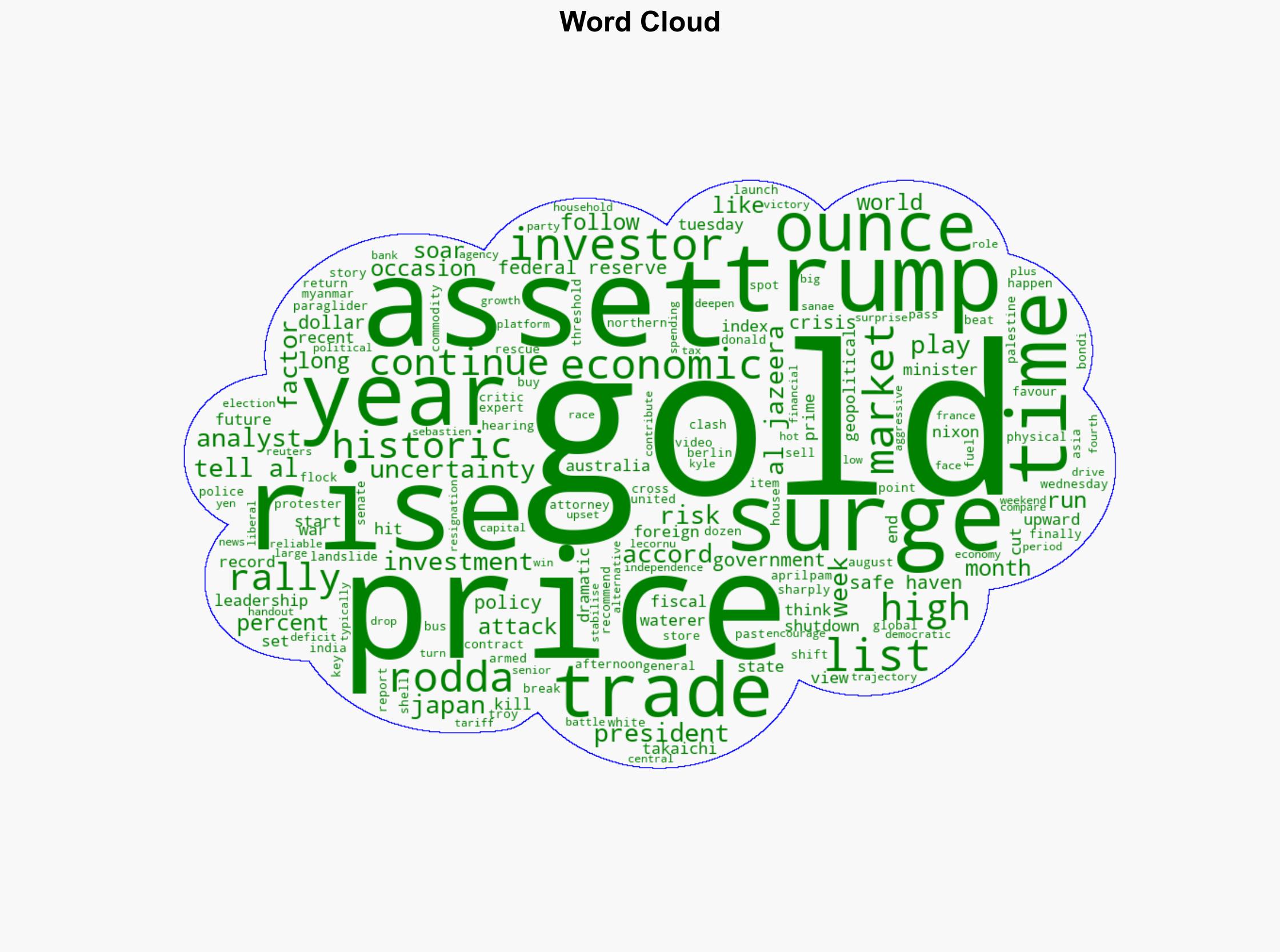

economic uncertainty, geopolitical risk, investment trends, global markets