Why Nvidia CEO Jensen Huangs Meeting with Taiwan Semi Is a Big Deal for NVDA Stock – Barchart.com

Published on: 2025-11-13

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

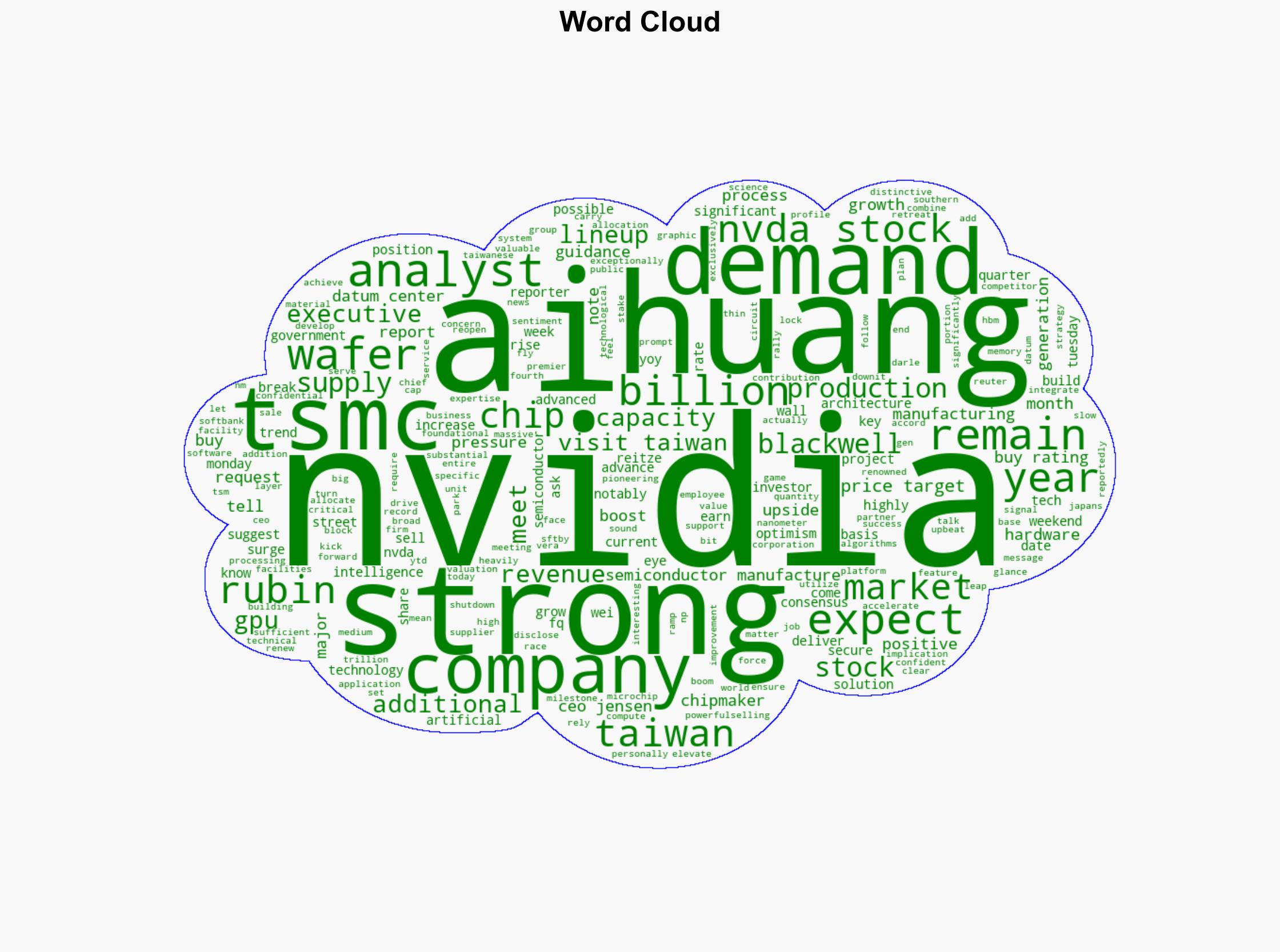

Intelligence Report: Why Nvidia CEO Jensen Huang’s Meeting with Taiwan Semi Is a Big Deal for NVDA Stock – Barchart.com

1. BLUF (Bottom Line Up Front)

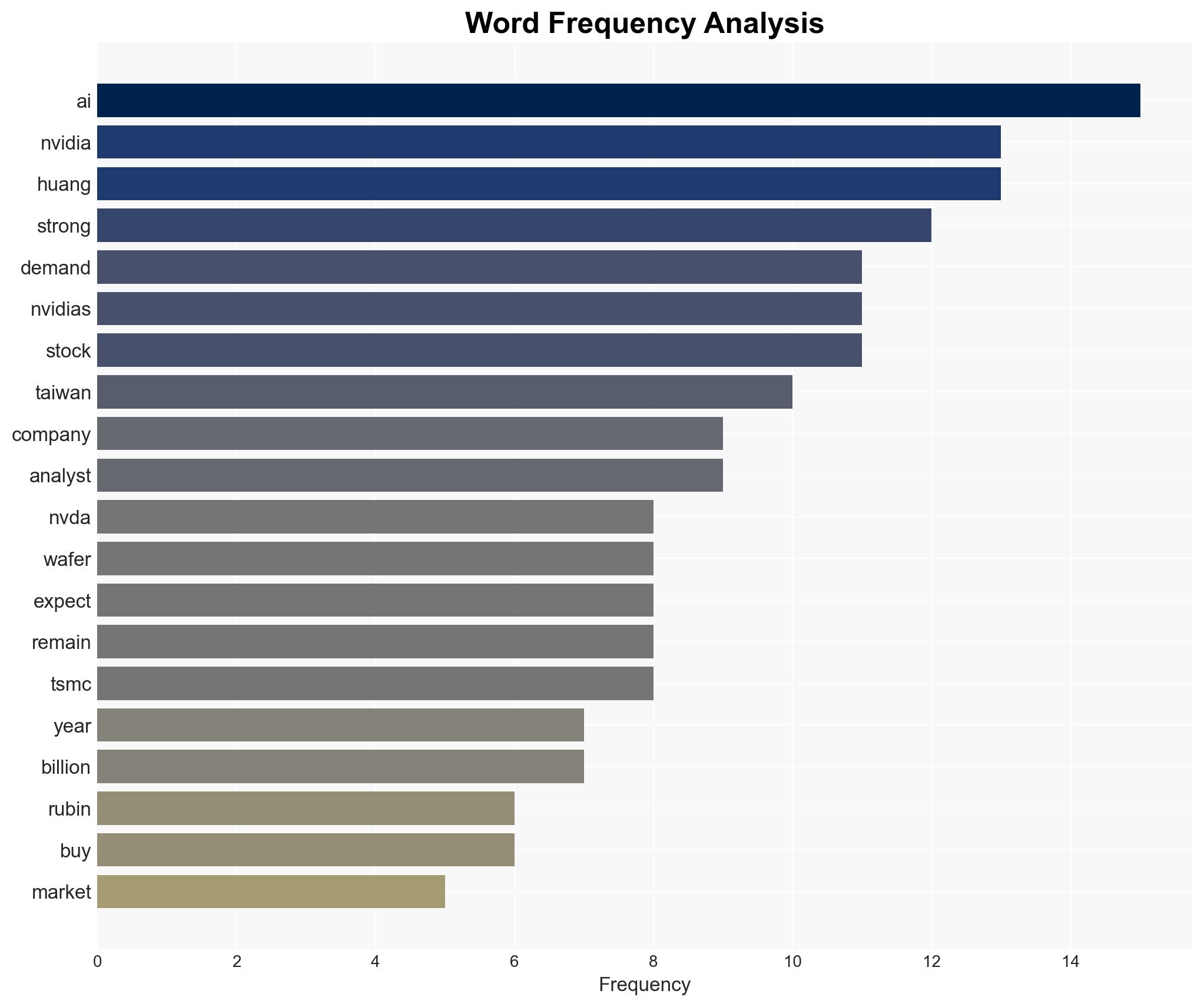

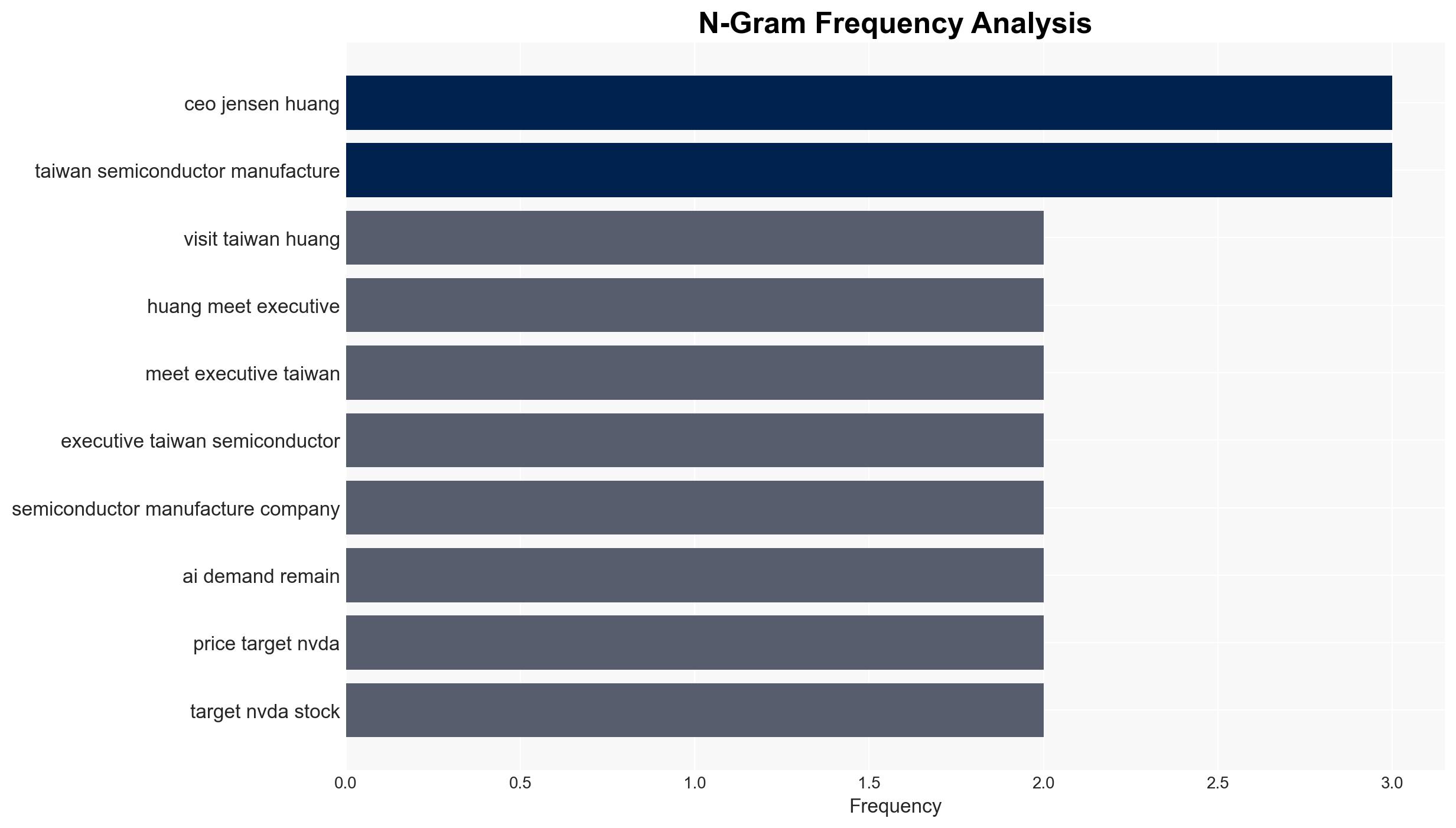

The strategic meeting between Nvidia CEO Jensen Huang and Taiwan Semiconductor Manufacturing Company (TSMC) executives signals a robust expectation of sustained AI demand, potentially influencing Nvidia’s stock positively. The most supported hypothesis is that Nvidia is proactively securing its supply chain to maintain its competitive edge in AI hardware. Confidence Level: Moderate. Recommended action: Monitor Nvidia’s supply chain developments and TSMC’s capacity expansion closely, as these will be critical to Nvidia’s ability to meet AI demand and influence stock performance.

2. Competing Hypotheses

Hypothesis 1: Nvidia’s meeting with TSMC is a strategic move to secure additional wafer supply due to anticipated sustained AI demand, ensuring Nvidia’s competitive advantage in the AI hardware market.

Hypothesis 2: The meeting is a routine engagement exaggerated by market speculation, with Nvidia’s demand projections being overly optimistic and potentially leading to overproduction risks.

Hypothesis 1 is more likely given the explicit request for increased wafer production and the strategic importance of TSMC’s advanced manufacturing capabilities to Nvidia’s AI product lineup.

3. Key Assumptions and Red Flags

Assumptions: Nvidia’s AI demand projections are accurate, and TSMC can meet the increased production requirements without significant delays.

Red Flags: Potential overreliance on a single supplier (TSMC) could pose risks if geopolitical tensions or supply chain disruptions occur. Market speculation may inflate expectations beyond realistic outcomes.

4. Implications and Strategic Risks

Economic Risks: If Nvidia’s demand projections are inaccurate, there is a risk of overproduction and inventory surplus, negatively impacting financial performance.

Political Risks: Geopolitical tensions involving Taiwan could disrupt TSMC’s operations, affecting Nvidia’s supply chain.

Cyber Risks: Increased demand for AI hardware could attract cyber threats targeting Nvidia’s intellectual property and supply chain.

5. Recommendations and Outlook

- Actionable steps: Diversify supply chain to mitigate risks associated with overreliance on TSMC. Enhance cybersecurity measures to protect intellectual property.

- Best Scenario: Nvidia successfully secures additional wafer supply, meets AI demand, and maintains stock growth.

- Worst Scenario: Geopolitical tensions disrupt TSMC operations, leading to supply shortages and financial losses for Nvidia.

- Most-likely Scenario: Nvidia secures necessary supply, but faces challenges in balancing production with actual demand.

6. Key Individuals and Entities

Jensen Huang (Nvidia CEO), TSMC (Taiwan Semiconductor Manufacturing Company)

7. Thematic Tags

Cybersecurity, Supply Chain Management, Geopolitical Risks, AI Hardware

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Methodology