Why this rocketing ASX rare earths stock is a big winner from the Trump-Albanese meeting – Motley Fool Australia

Published on: 2025-10-21

Intelligence Report: Why this rocketing ASX rare earths stock is a big winner from the Trump-Albanese meeting – Motley Fool Australia

1. BLUF (Bottom Line Up Front)

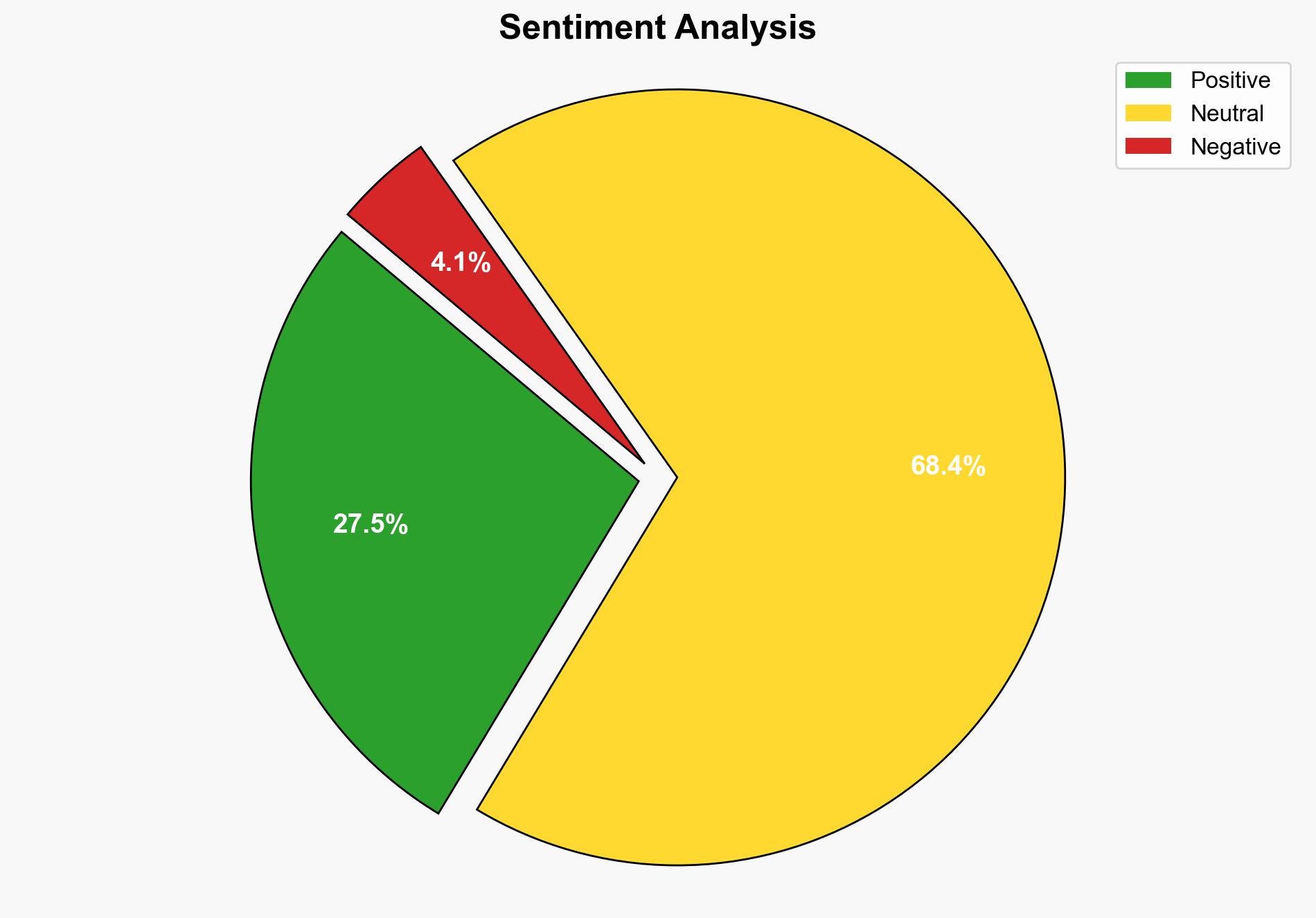

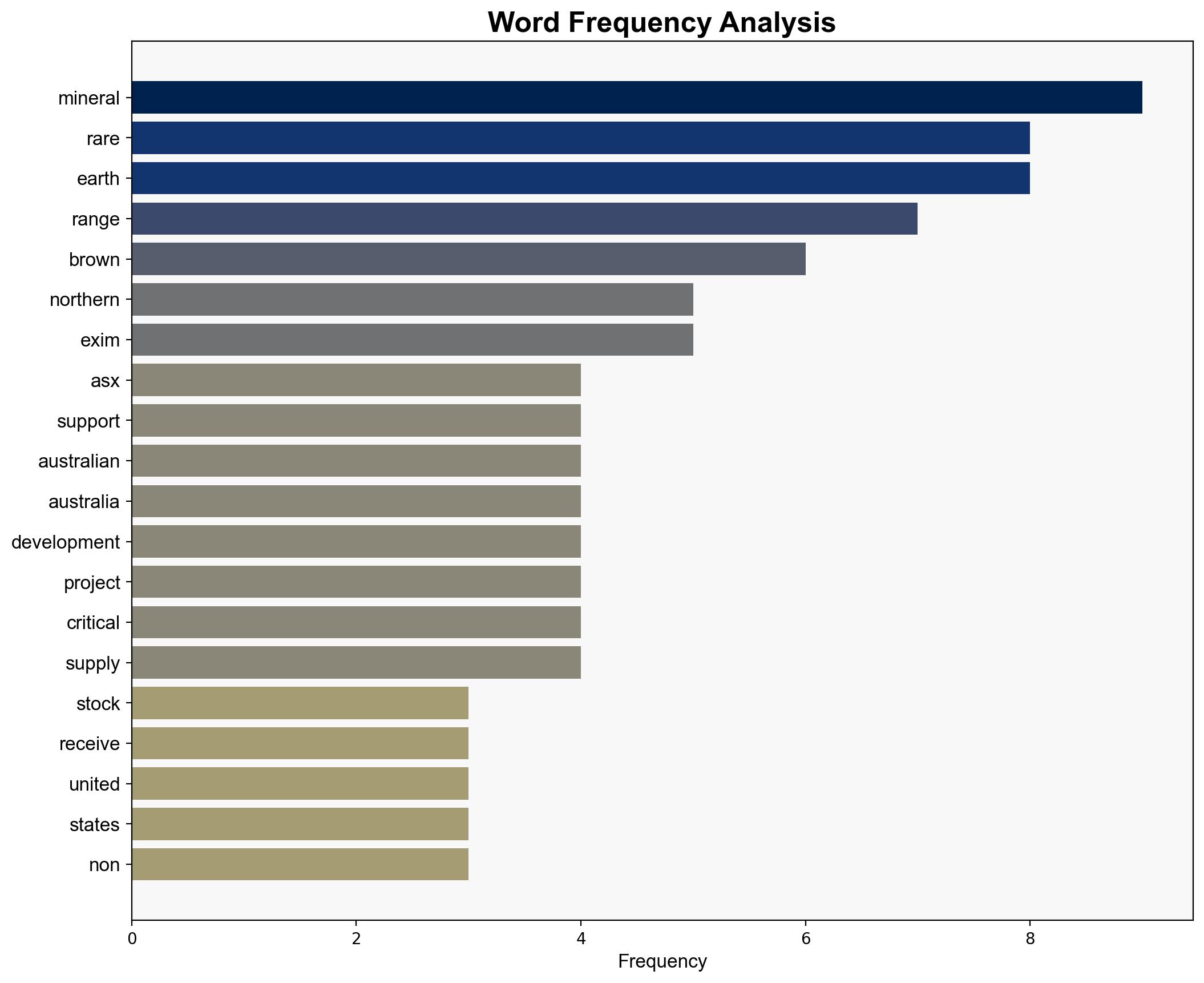

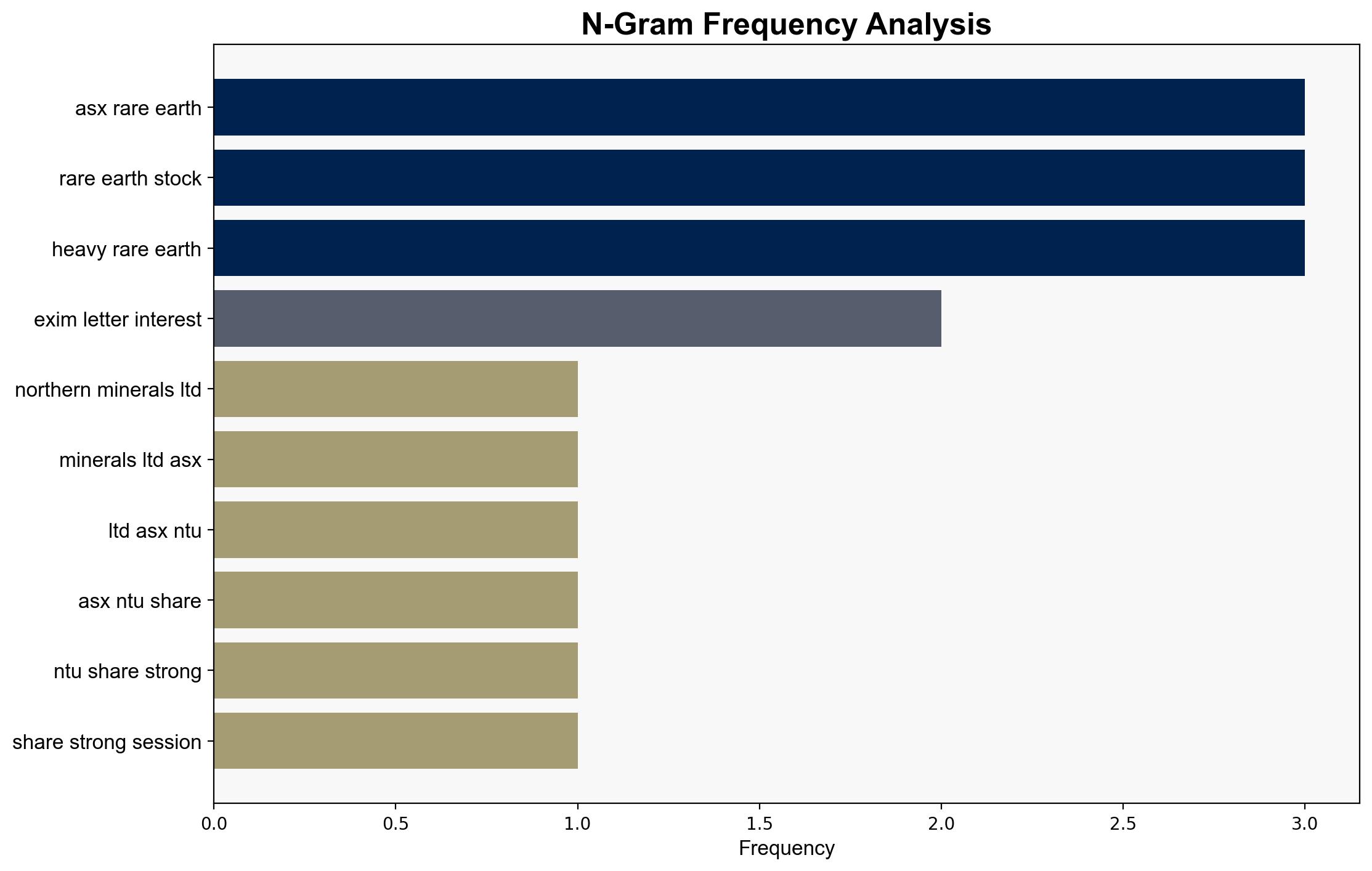

The strategic judgment is that Northern Minerals Ltd’s recent gains are primarily driven by geopolitical shifts towards securing non-Chinese supply chains for critical minerals, supported by U.S. and Australian government backing. Confidence level: Moderate. The most supported hypothesis is that the Trump-Albanese meeting catalyzed this support, aligning with broader strategic interests. Recommended action: Monitor further governmental support developments and assess Northern Minerals’ capacity to meet strategic mineral demands.

2. Competing Hypotheses

1. **Hypothesis A**: The Trump-Albanese meeting directly influenced the support from the U.S. and Australian agencies, reflecting a strategic pivot to secure non-Chinese rare earth supply chains.

– **Support**: The meeting emphasized collaboration on critical minerals, aligning with the EXIM and EFA’s support for Northern Minerals.

2. **Hypothesis B**: The support for Northern Minerals is primarily driven by market forces and the inherent value of the Browns Range project, independent of the Trump-Albanese meeting.

– **Support**: The Browns Range project is highlighted as a globally significant resource, with or without direct political influence.

Using ACH 2.0, Hypothesis A is better supported due to the timing and explicit mention of the meeting’s outcomes in the context of the support letters.

3. Key Assumptions and Red Flags

– **Assumptions**:

– The Trump-Albanese meeting had a direct impact on the decision-making of EXIM and EFA.

– Northern Minerals can effectively capitalize on the support to develop the Browns Range project.

– **Red Flags**:

– The non-binding nature of the support letters may not translate into actual financial backing.

– Potential over-reliance on geopolitical narratives to drive stock value, which could be speculative.

4. Implications and Strategic Risks

– **Economic**: Successful development of the Browns Range project could reduce dependency on Chinese rare earths, impacting global supply chains.

– **Geopolitical**: Strengthened U.S.-Australia ties in critical minerals could provoke responses from China, potentially affecting trade relations.

– **Strategic Risks**: Failure to secure binding financial support could lead to project delays, impacting stock performance and strategic objectives.

5. Recommendations and Outlook

- Monitor developments in U.S.-Australia critical mineral agreements for further support indications.

- Evaluate Northern Minerals’ operational capacity and financial health to ensure project viability.

- Scenario Projections:

– **Best Case**: Binding financial support is secured, leading to rapid project development and increased stock value.

– **Worst Case**: Support remains non-binding, leading to project delays and stock volatility.

– **Most Likely**: Gradual progress with intermittent support, maintaining moderate stock growth.

6. Key Individuals and Entities

– Shane Hartwig (Northern Minerals CEO)

– John Jovanovic (EXIM Chair)

– Northern Minerals Ltd

– Export Finance Australia (EFA)

– Export-Import Bank of the United States (EXIM)

7. Thematic Tags

national security threats, geopolitical strategy, critical minerals, U.S.-Australia relations