Will President Trumps Focus on Affordability Alter Interest Rates Push – Daily Signal

Published on: 2025-11-16

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report:

1. BLUF (Bottom Line Up Front)

With moderate confidence, it is assessed that President Trump’s focus on affordability is unlikely to significantly alter the Federal Reserve’s interest rate policy in the short term. The most supported hypothesis is that while Trump’s rhetoric may influence public perception and political discourse, the Federal Reserve will maintain its independence and continue to prioritize inflation control over political pressures. It is recommended that policymakers and stakeholders prepare for continued economic volatility and focus on long-term fiscal strategies.

2. Competing Hypotheses

Hypothesis 1: President Trump’s focus on affordability will lead to a shift in the Federal Reserve’s interest rate policy, resulting in lower rates to stimulate economic growth and reduce consumer costs.

Hypothesis 2: Despite President Trump’s emphasis on affordability, the Federal Reserve will maintain its current trajectory, prioritizing inflation control over political pressures, and interest rates will remain stable or increase slightly.

Hypothesis 2 is more likely given the Federal Reserve’s historical commitment to independence and its current focus on managing inflation, as well as the lack of direct influence the executive branch has over monetary policy.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that the Federal Reserve will continue to act independently and prioritize inflation control. It is also assumed that President Trump’s influence over the Federal Reserve is limited to public discourse rather than direct policy changes.

Red Flags: Any indication of political pressure influencing Federal Reserve decisions would be a significant red flag. Additionally, unexpected shifts in economic indicators or policy statements from key Federal Reserve officials could signal a change in direction.

4. Implications and Strategic Risks

If the Federal Reserve were to lower interest rates due to political pressure, it could undermine its credibility and lead to increased inflation, exacerbating economic instability. Conversely, maintaining or increasing rates could slow economic growth and exacerbate affordability issues, leading to political and public dissatisfaction. The potential for misinformation or misinterpretation of economic policies could also influence public sentiment and market reactions.

5. Recommendations and Outlook

- Monitor Federal Reserve communications and economic indicators closely to anticipate potential shifts in policy.

- Engage in public education campaigns to clarify the Federal Reserve’s role and the importance of its independence.

- Best-case scenario: The Federal Reserve maintains its independence, and inflation is controlled without significant political interference.

- Worst-case scenario: Political pressures lead to premature rate cuts, resulting in increased inflation and economic instability.

- Most-likely scenario: The Federal Reserve continues its current policy trajectory, with minor adjustments based on economic data.

6. Key Individuals and Entities

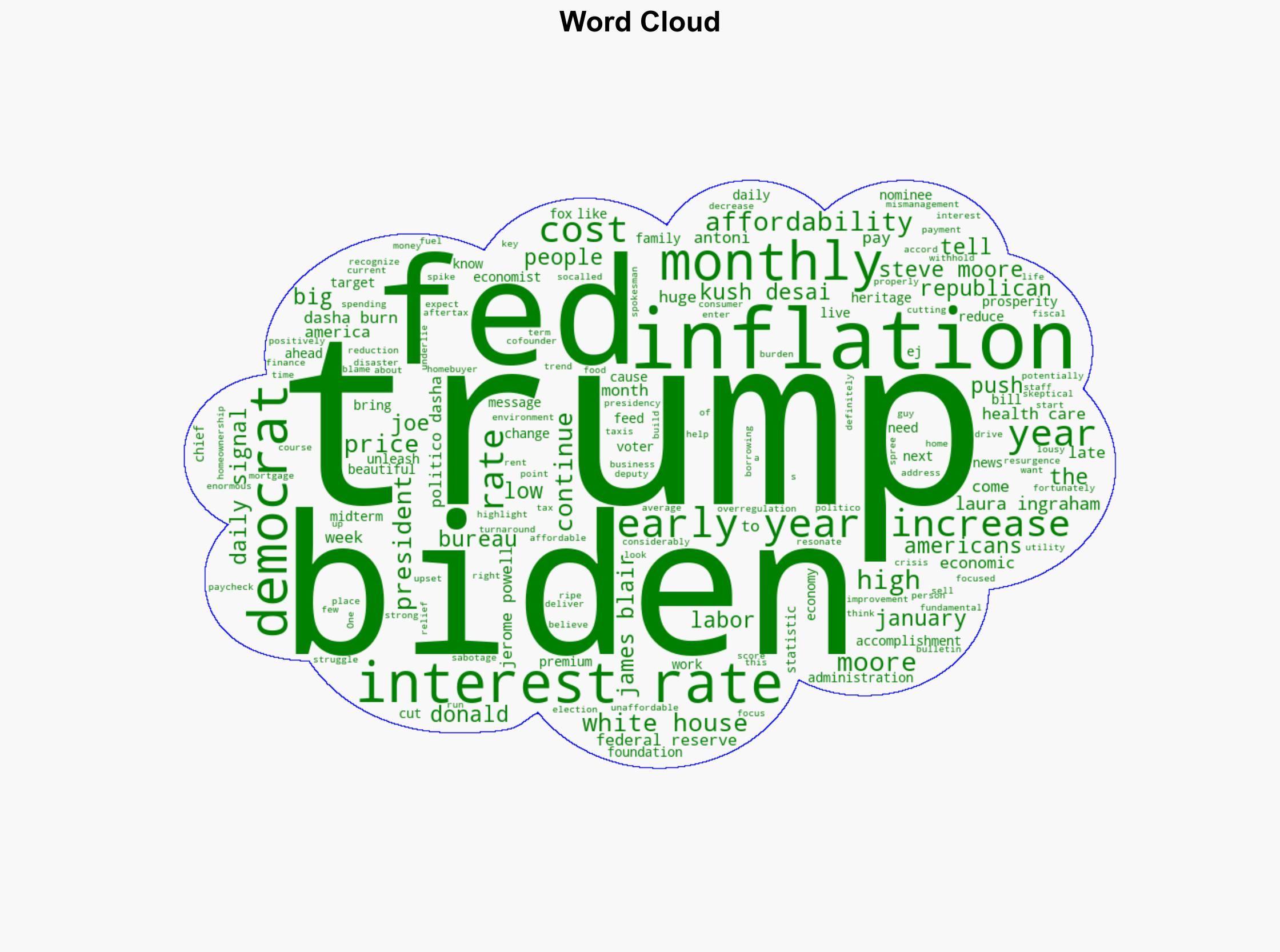

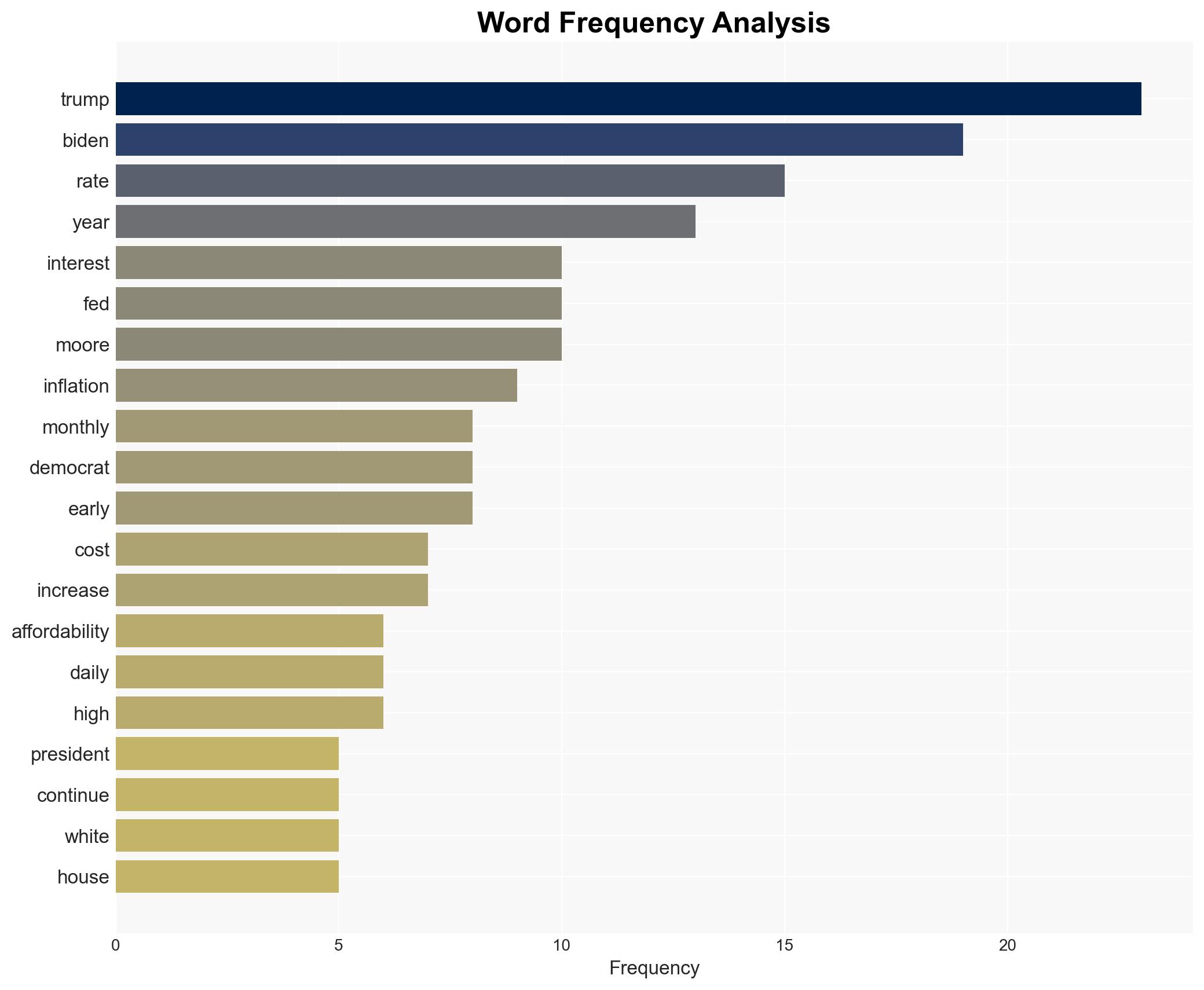

Donald Trump, Jerome Powell, Steve Moore, EJ Antoni

7. Thematic Tags

National Security Threats, Economic Policy, Federal Reserve Independence, Inflation Control

Structured Analytic Techniques Applied

- Cognitive Bias Stress Test: Expose and correct potential biases in assessments through red-teaming and structured challenge.

- Bayesian Scenario Modeling: Use probabilistic forecasting for conflict trajectories or escalation likelihood.

- Network Influence Mapping: Map relationships between state and non-state actors for impact estimation.

Explore more:

National Security Threats Briefs ·

Daily Summary ·

Support us

·