Wipro net up marginally in Q2 – The Times of India

Published on: 2025-10-17

Intelligence Report: Wipro net up marginally in Q2 – The Times of India

1. BLUF (Bottom Line Up Front)

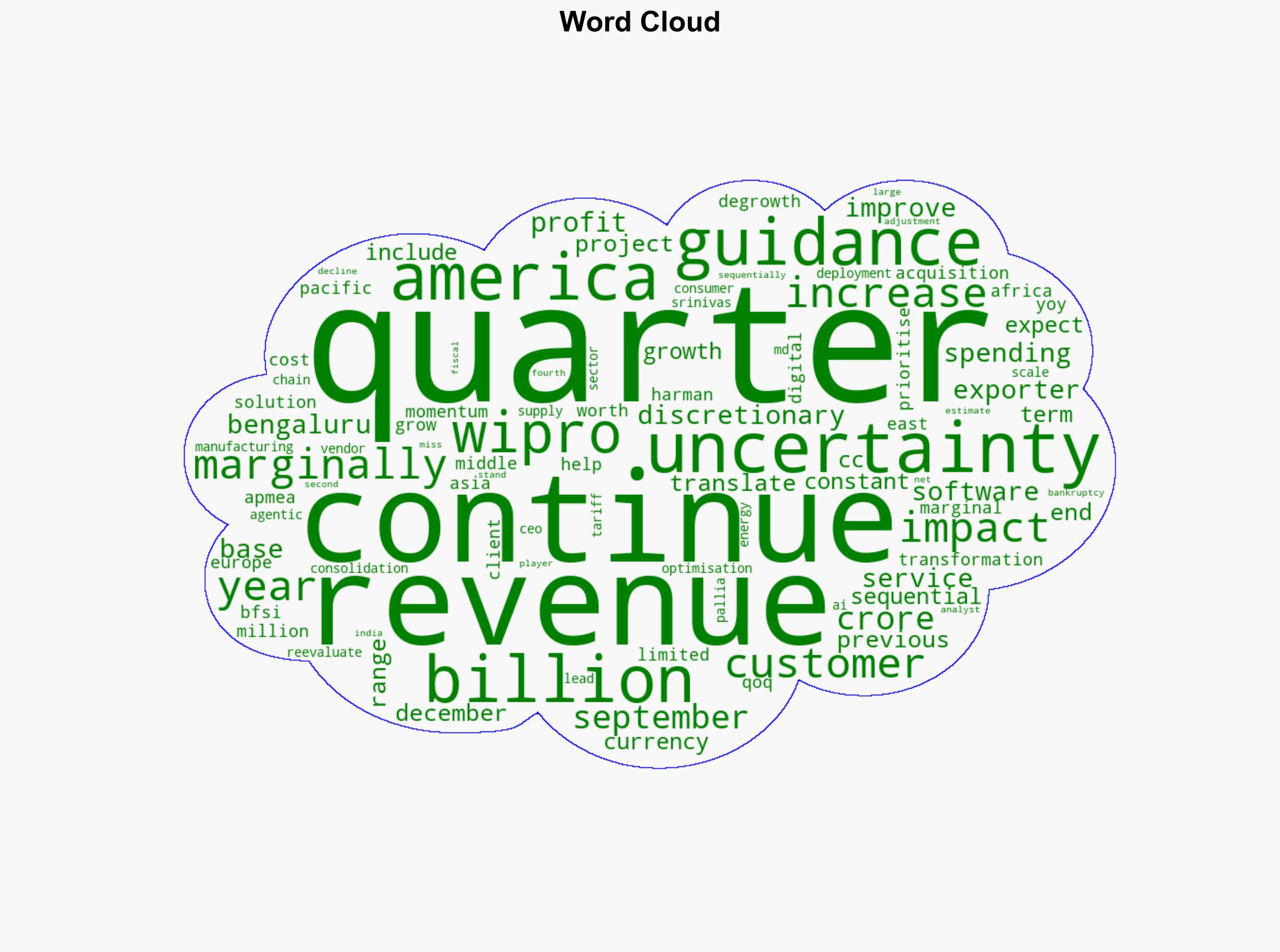

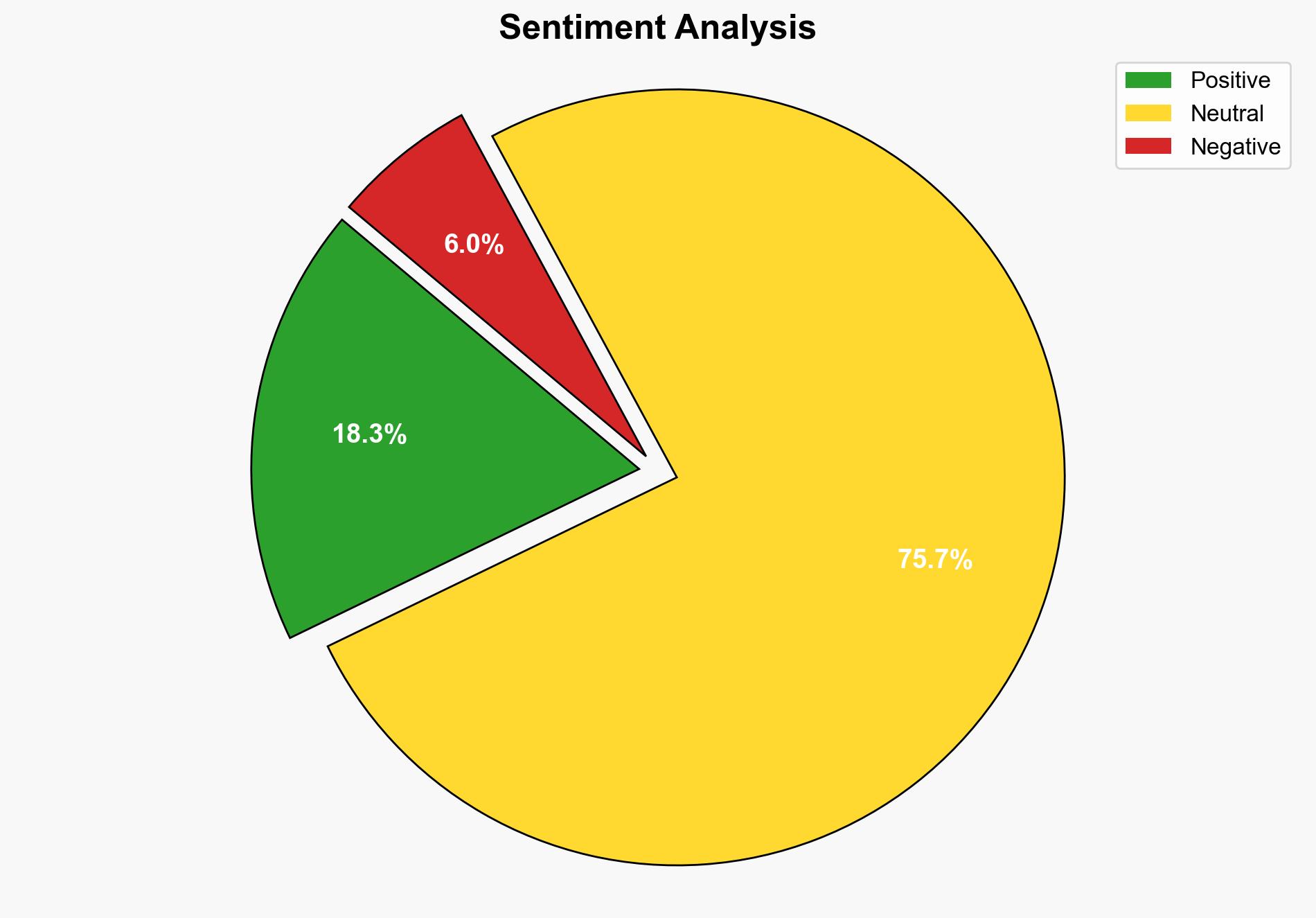

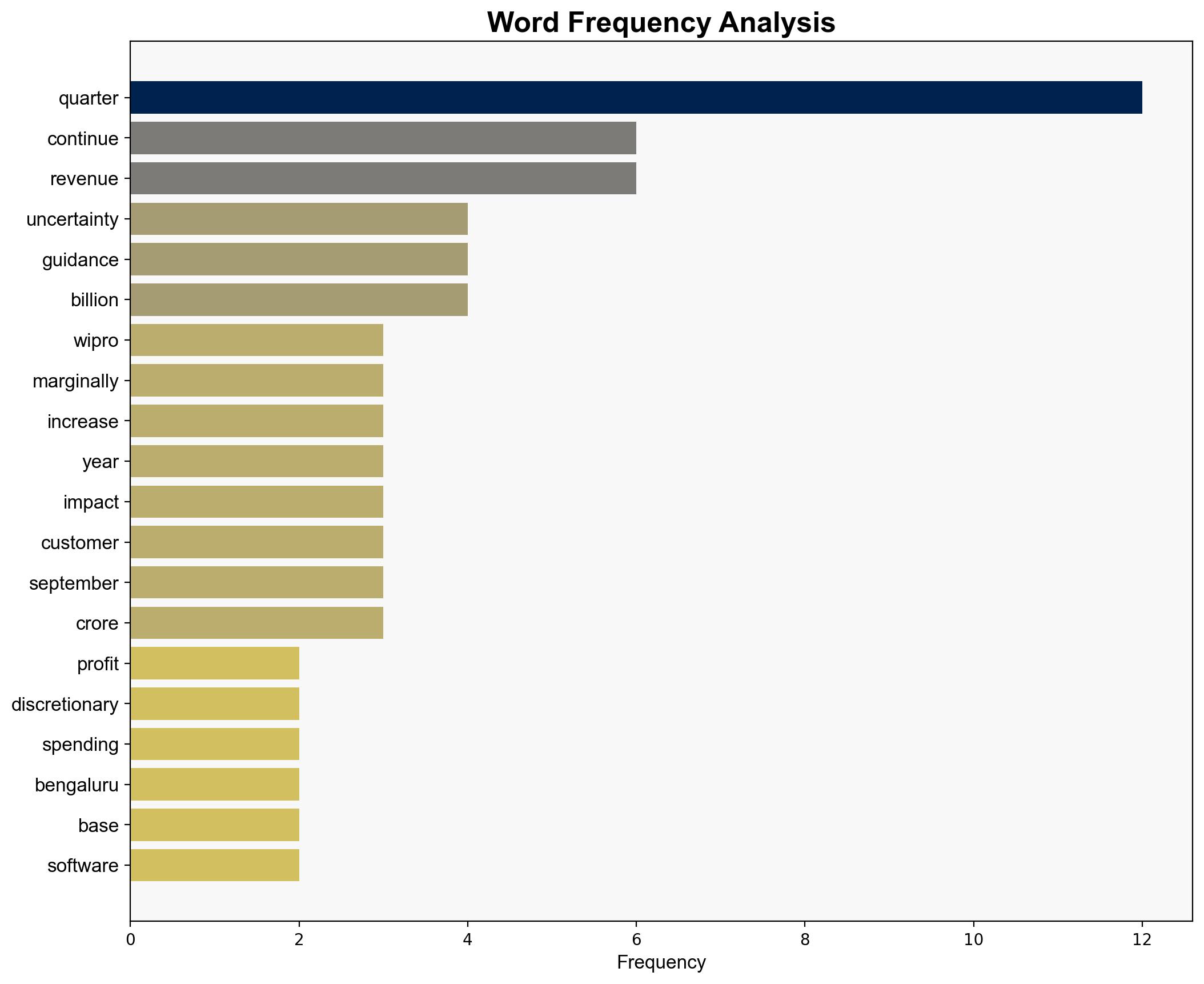

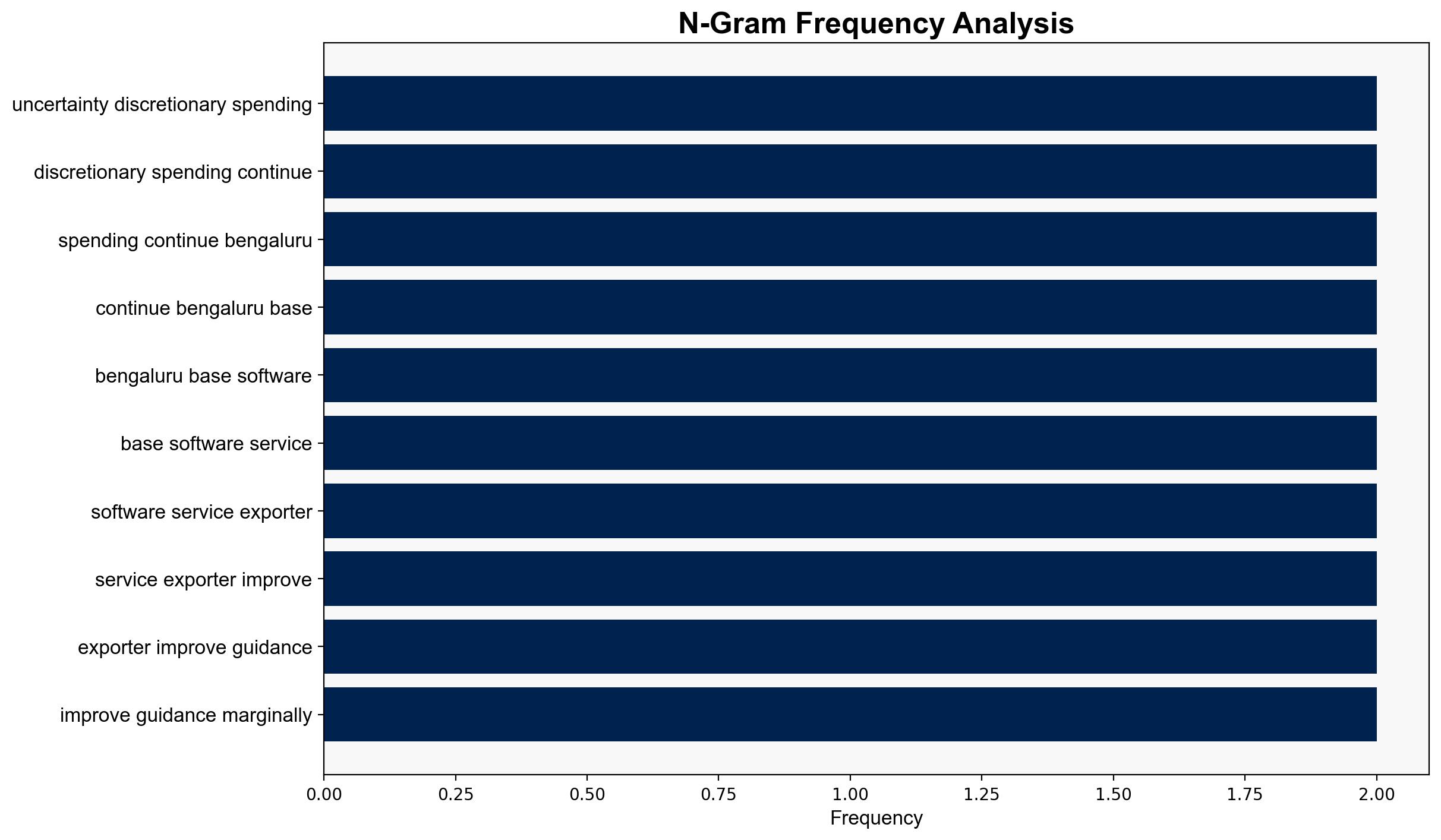

Wipro’s marginal net profit increase in Q2, despite missing analyst estimates, suggests ongoing challenges in discretionary spending and market uncertainties. The most supported hypothesis indicates that Wipro’s strategic adjustments and guidance improvements are insufficient to counteract broader market pressures. Confidence level: Moderate. Recommended action: Wipro should intensify efforts in cost optimization and diversification to mitigate risks from sector-specific downturns.

2. Competing Hypotheses

1. **Hypothesis A**: Wipro’s marginal profit increase reflects effective strategic adjustments and resilience in a challenging market environment. The company’s guidance improvement and revenue growth in specific regions indicate a potential recovery trajectory.

2. **Hypothesis B**: The marginal profit increase is primarily due to temporary factors, such as specific regional growth, and does not signify a sustainable recovery. Broader market uncertainties and sector-specific challenges continue to impede significant growth.

Using ACH 2.0, Hypothesis B is better supported due to consistent references to ongoing uncertainties and sector-specific challenges, such as discretionary spending and supply chain reevaluations, which overshadow the marginal improvements.

3. Key Assumptions and Red Flags

– **Assumptions**: Both hypotheses assume that Wipro’s strategic guidance is accurately reflective of market conditions. Hypothesis A assumes that regional growth trends will continue, while Hypothesis B assumes that market uncertainties will persist.

– **Red Flags**: Potential over-reliance on regional growth without addressing broader market challenges. Inconsistent data on the impact of AI deployment and vendor consolidation.

– **Blind Spots**: Lack of detailed analysis on the impact of geopolitical factors and tariff uncertainties on Wipro’s operations.

4. Implications and Strategic Risks

– **Economic Risks**: Continued uncertainty in discretionary spending could lead to reduced client investments, impacting revenue.

– **Geopolitical Risks**: Tariff uncertainties and geopolitical tensions may disrupt supply chains and affect market stability.

– **Sector-Specific Risks**: Challenges in the energy and manufacturing sectors may lead to further reevaluation of supply chains, impacting Wipro’s client base.

5. Recommendations and Outlook

- Wipro should enhance its focus on cost optimization and diversification to mitigate sector-specific risks.

- Invest in strengthening AI and digital transformation capabilities to drive long-term growth.

- Scenario Projections:

- Best Case: Successful diversification and strategic adjustments lead to sustained growth.

- Worst Case: Continued market uncertainties and sector-specific downturns result in stagnation or decline.

- Most Likely: Moderate growth with ongoing challenges in discretionary spending and sector-specific issues.

6. Key Individuals and Entities

– Srinivas Pallia

– Harman Digital Transformation Solutions

7. Thematic Tags

economic uncertainty, market analysis, strategic planning, regional growth, digital transformation