XRP Stabilizes After Early Dip Traders Eye 240 Breakout – CoinDesk

Published on: 2025-10-18

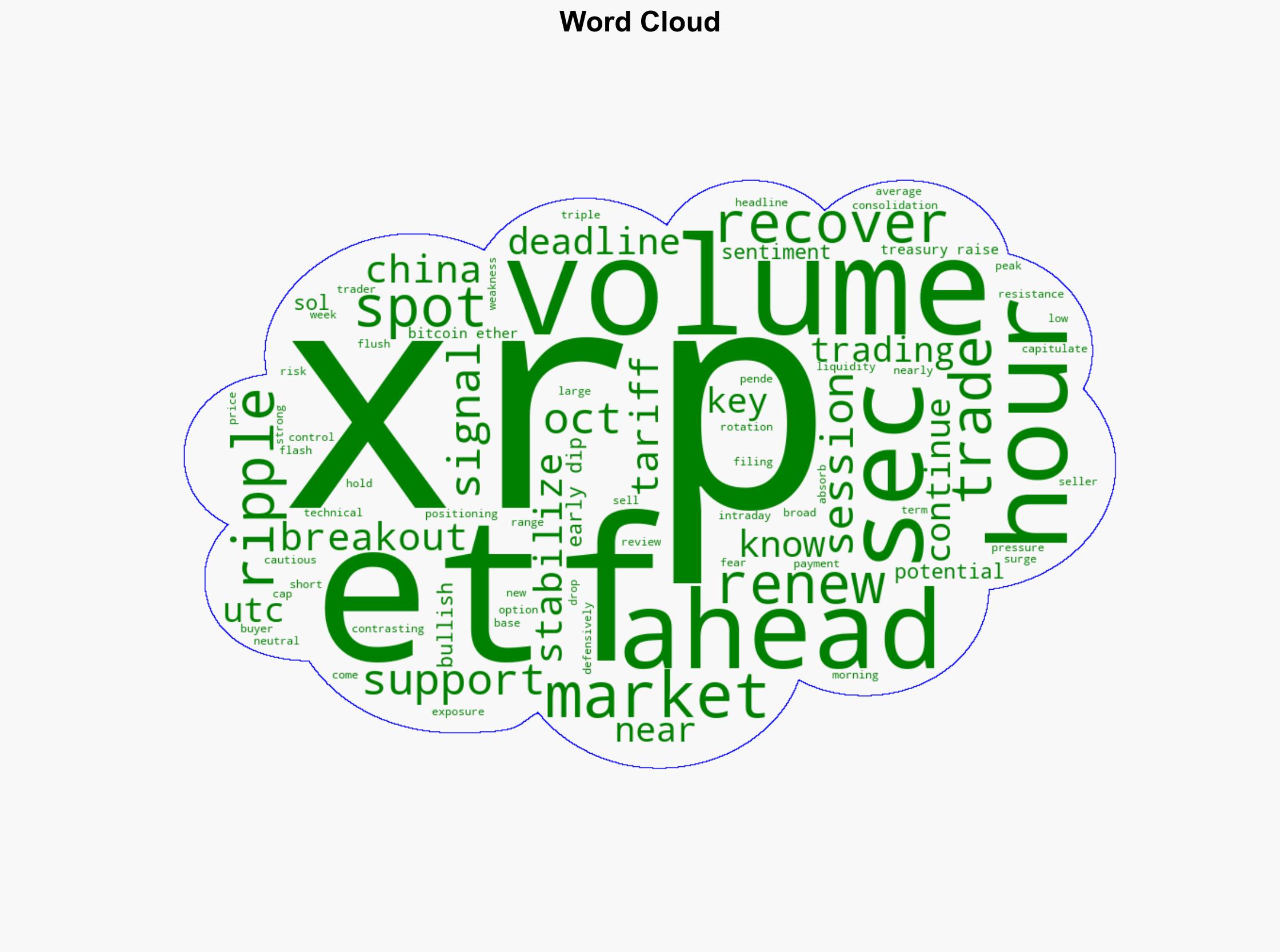

Intelligence Report: XRP Stabilizes After Early Dip Traders Eye 240 Breakout – CoinDesk

1. BLUF (Bottom Line Up Front)

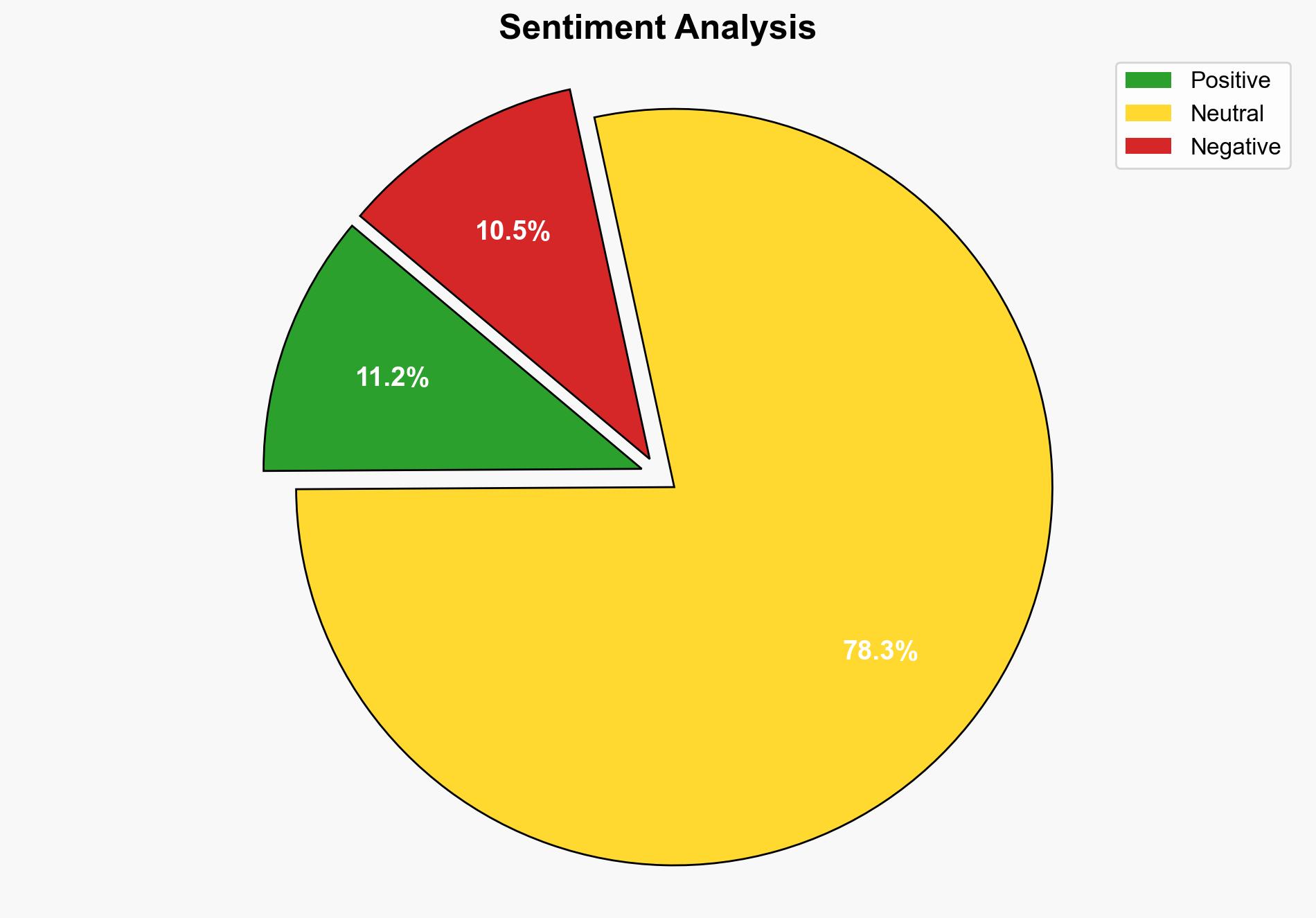

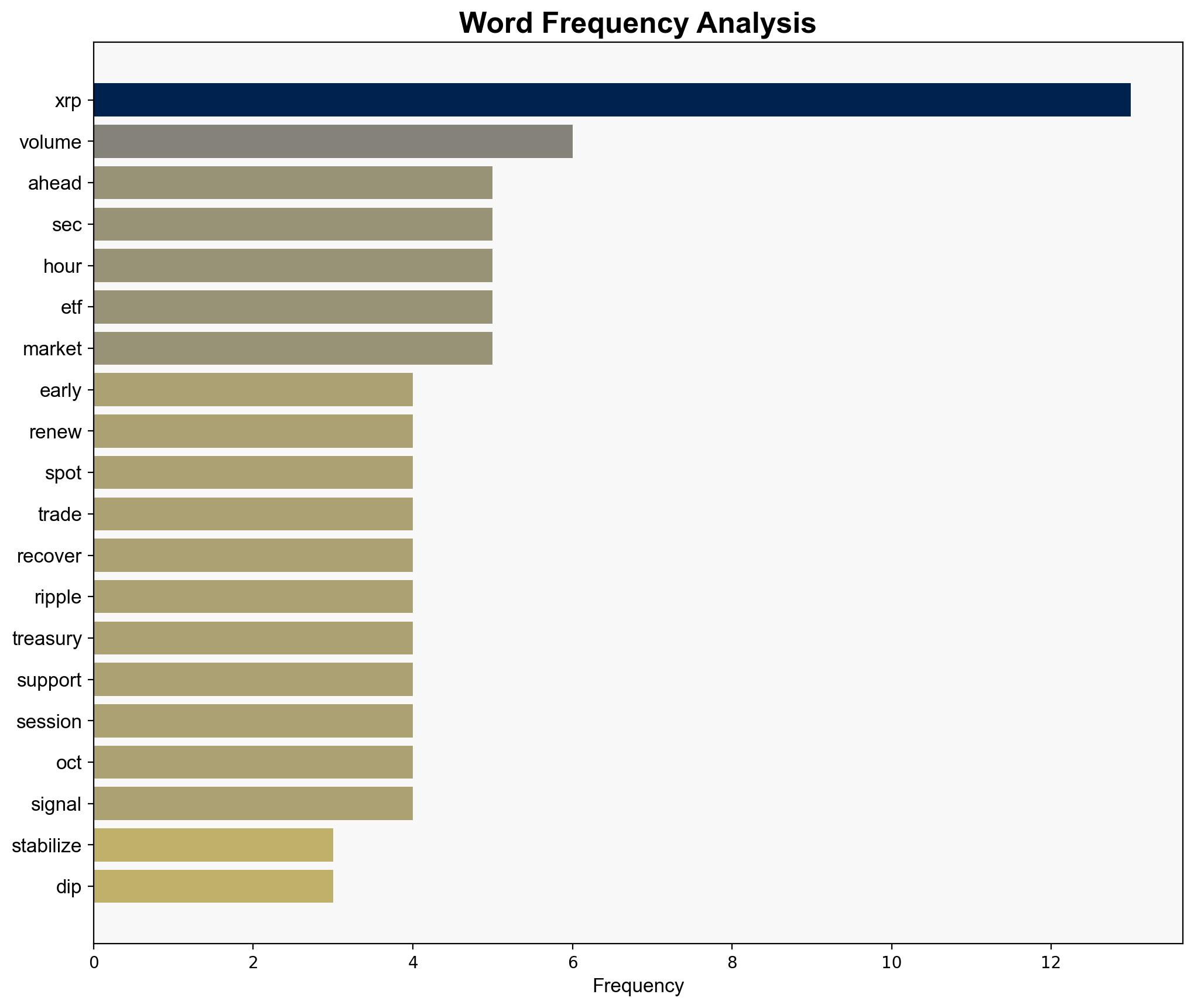

XRP’s recent stabilization after an early dip, driven by large buyer absorption and renewed interest, suggests a potential breakout, contingent on upcoming SEC decisions regarding spot XRP ETFs. The most supported hypothesis is that XRP will maintain its current support levels and potentially break out if the SEC decision is favorable. Confidence level: Moderate. Recommended action: Monitor SEC developments closely and prepare for potential market shifts.

2. Competing Hypotheses

Hypothesis 1: XRP will maintain stability and potentially break out if the SEC approves spot XRP ETFs. This hypothesis is supported by the current defensive trading patterns, large buyer absorption, and increased trading volume indicating strong market interest.

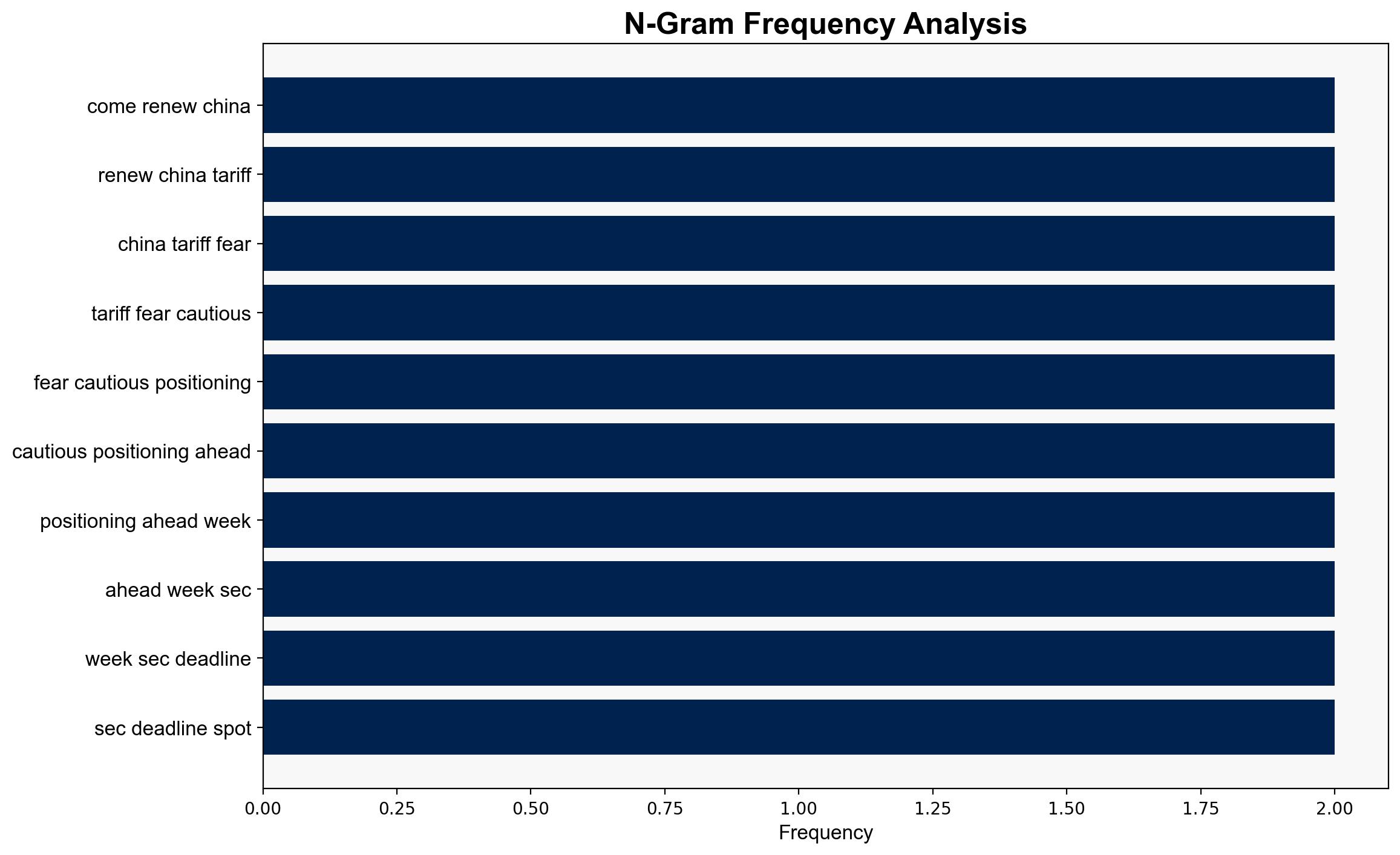

Hypothesis 2: XRP will face continued volatility and potential decline due to macroeconomic pressures, such as renewed China tariff fears and broader crypto market weakness. This is supported by the initial dip and the overall drop in the crypto market cap.

3. Key Assumptions and Red Flags

Assumptions:

– The SEC decision on spot XRP ETFs will significantly impact XRP’s price trajectory.

– Large buyer absorption indicates sustained interest and potential for a breakout.

Red Flags:

– Over-reliance on SEC decisions without considering broader market conditions.

– Potential for deceptive market signals if large buyers are manipulating prices.

4. Implications and Strategic Risks

– A favorable SEC decision could lead to a significant price increase for XRP, impacting investor strategies and market dynamics.

– Continued macroeconomic pressures, such as tariff escalations, could dampen crypto liquidity and lead to broader market instability.

– Psychological impacts on traders due to uncertainty around SEC decisions could lead to increased volatility.

5. Recommendations and Outlook

- Monitor SEC announcements closely and adjust trading strategies accordingly.

- Prepare for potential volatility by setting stop-loss orders and diversifying portfolios.

- Scenario Projections:

- Best Case: SEC approves ETFs, leading to a significant XRP price breakout.

- Worst Case: SEC rejects ETFs, combined with macroeconomic pressures, leading to a sharp decline in XRP value.

- Most Likely: XRP maintains current support levels with moderate fluctuations until the SEC decision is made.

6. Key Individuals and Entities

– Ripple (entity involved in XRP’s market activities and treasury initiatives)

– SEC (decision-making body on ETF approvals)

7. Thematic Tags

financial markets, cryptocurrency, regulatory impact, market volatility